- Published on November 27, 2021

- Edit article

- View stats

Why Credit Repair is the Mortgage and Real Estate Industry’s Unsung Hero in the Trenches

Errors on Credit Reports Can Cost Your Clients Thousands in Interest and Possibly Approval

Qualifying for mortgage lending for many consumers, even those with decent credit can be a daunting task. So much goes into the decision process to decide if the consumer is lending ready. Is the consumer credit worthy? How have they handled credit in the past? How are they handling it presently? Do they have the capacity to handle the obligation of repayment over 15-30 years? Lenders justifiably want to see the consumer can handle the biggest financial decision and obligation of their lives. Putting aside obvious indicators such as work history, income, and age; lenders use credit reports from the 3 major credit bureaus (Equifax, Experian, and Trans Union) to make an informed decision on a consumer’s lendability.

The credit report is a great indicator for lenders to use to guage a consumer’s credit worthiness. Credit reports paint a picture and tells a story about the consumer. You can see up to 10 years of the consumer’s history (longer if the consumer has an open item over 10 years old), and see their current status. But what if the story being told by the credit report isn’t accurate, or painting the whole picture? Is it costing your client pre-approval or THOUSANDS in interest? A recent study by Consumer Reports shows that at least 34% of consumers find errors in their credit reports. What if I told you; I have yet to see an accurate credit report.

How is Credit Reported?

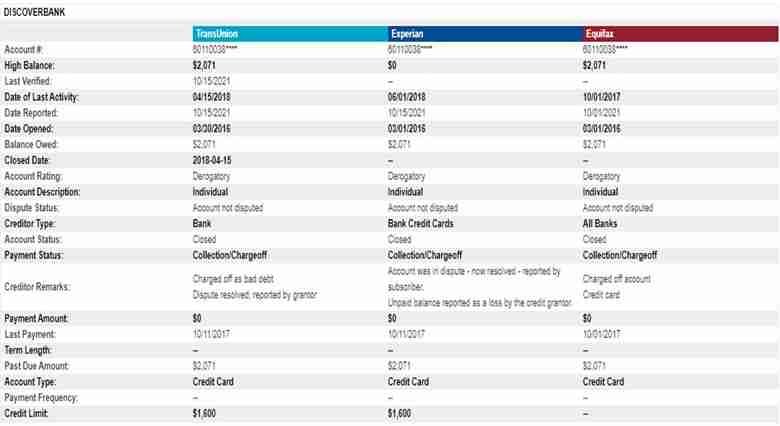

In order to understand how inaccuracies are affecting our clients; we must first understand the basics behind credit reporting laws, and how data furnishers (creditors, collectors, data miners, etc.) submit information to the credit bureaus. The credit bureaus and furnishers both must follow the Fair Credit Reporting Act (FCRA) when reporting anything on a consumer. Collection agencies, in addition to the FCRA, must also follow the Fair Debt Collection Practices Act (FDCPA). We will just focus on the FCRA for this article. The FCRA is a procedural driven statute, that mandates the credit bureaus must have “reasonable procedures” for many aspects of credit reporting, such as reasonable procedures to conduct a reinvestigation when a dispute comes in, procedures to ensure “maximum possible accuracy”, and that the data is verifiable. Notice the FCRA uses the term “maximum possible”. To meet that standard, the credit reporting industry (CDIA) came up with a way for furnishers to submit data to the 3 major credit bureaus in the same format. This centralized format is called Metro2. In Theory if a furnisher is submitting the data on a consumer using same format, then the data should be the same across all 3 bureaus right? One would think so but that is not what we find. In the picture above you will notice an account that is seemingly reporting differently across all 3 credit bureaus.

How Inaccurate and Missing Metro2 Data Affects A Consumer’s Credit Score.

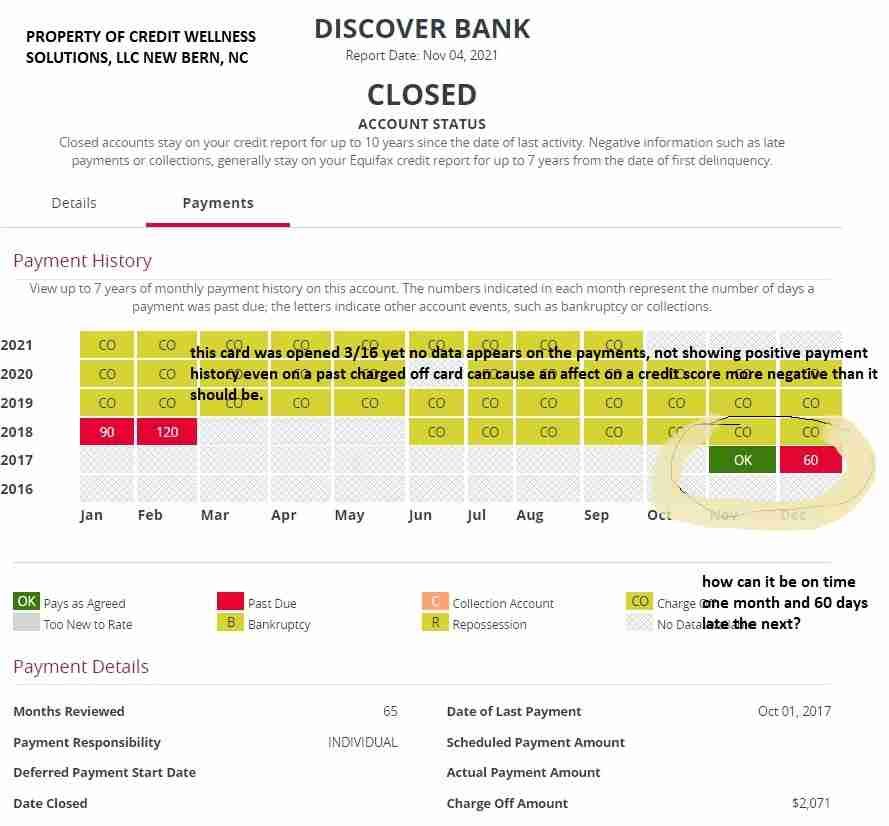

Credit scores, Fico or Vantage scores are generated by all the data on a consumer’s credit file. Pictured is the same Discover Card account in the prior section. Notice before the charge-off status, no payment history is reporting. This account was opened in 2016 and went into charge-off status in 2018. Knowing the fact that credit scores are generated by the data in the credit report, would it be reasonable to suspect that the missing positive payment history prior to the charge-off is costing this consumer a couple points? Also notice that there was an “on time” payment recorded, followed by a 60-Day late reporting. That is impossible, as there are only 31 days maximum in a month. So is it reasonable to believe that the scoring models see this and it costs them another couple points? Then factor in the other missing data, and inaccuracies in the other picture, who knows what this one tradeline cost this consumer as far as points. Then let’s add in other tradelines, you get the point. You might argue that the credit score damage would be minimal however, in mortgage lending what is the difference between a 615 and a 620 middle score? Approval or denial. Keep in mind, errors like these affect all consumers, even consumers with good credit, potentially costing them THOUSANDS in interest over the life of a mortgage.

The Dispute Process Begins…

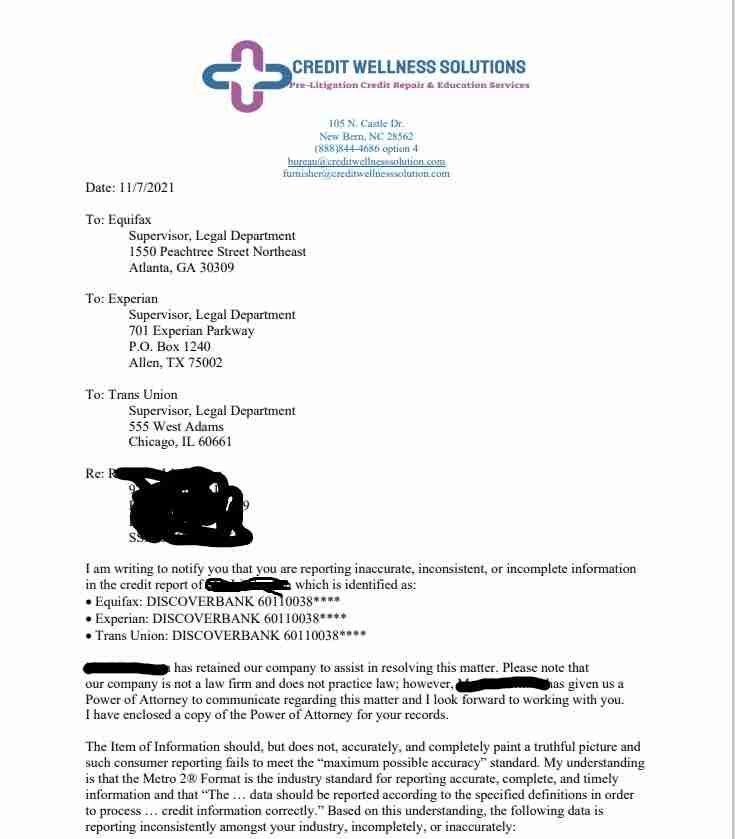

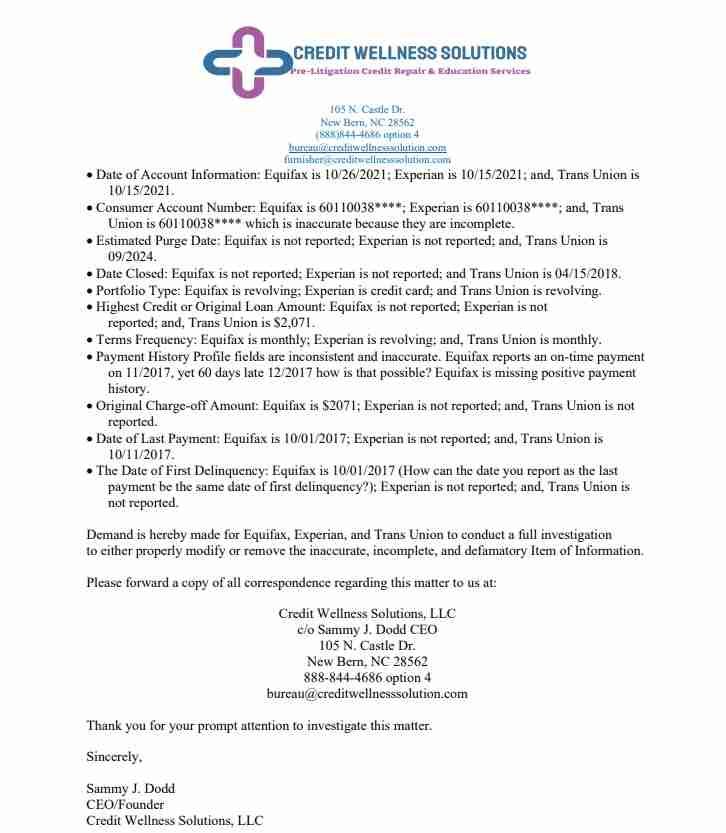

Fortunately, the FCRA affords the consumer the opportunity to correct errors on their credit reports. The dispute process can be done themselves or though a credit service organization. There are many methods and avenues of dispute, some based upon facts, while others based on a wing and a prayer. Of course a good credit service organization only uses fact based disputes. For my company, Credit Wellness Solutions LLC our main method of disputing is Pre-Litigation. Pre-Litigation disputing is not exactly like it sounds. The end goal of a Pre-Litigation dispute is to get inaccurate information corrected or deleted, and get unverifiable information deleted. Pre-Litigation disputing is not designed to get the consumer in a courtroom, or to threaten the credit bureaus and furnishers with lawsuits. Instead, Pre-Litigation disputing is driven by sticking solely to the facts, never quoting law, never threatening lawsuits, but written in the mindset that a judge, or jury may see the communication. A dispute should be easy to understand, with no question as to what is being disputed. Below is an example of a dispute using the same Discover Card account.

Notice there is a listing of every error, missing, and inconsistencies. No quotes of law, and even a snapshot of the reporting amongst the 3 bureaus. It spells out every issue, leaving no room for confusion. You may argue that Metro2 is not the law, and you would be correct. Metro2 is only an industry standard. However, remember the FCRA is a procedural based statute. Metro2 is the procedure created to meet the law of “maximum possible accuracy” and verifiable data. So if the bureaus and furnishers are not following their own industry standard, then the reporting is not reported with maximum possible accuracy. If the bureaus or furnishers fail to correct or delete the information, then they are in violation of the FCRA, as it can be proven their procedures have failed. Just as a note before you read further, I am not an attorney or law firm and any statement in this article should not be taken as legal advice. By all means this one dispute should be sufficient, but personally I like to build a case that an attorney can run with. If the items listed are not addressed in my first letter, I will send a second letter to the bureaus, if that fails to get the item fixed or deleted, I send a letter directly to the furnisher. If that fails to get the item fixed or deleted, then I forward the file to a consumer protection attorney for possible litigation. As mentioned, the end goal is not litigation, but rather in preparation for litigation, if needed, to ensure the consumer’s credit file is maximum possible accuracy. Remember, even small errors can cause score damage which could be costing the consumer the approval, or costing them THOSANDS in interest.

The Value of Credit Building and Rebuilding.

Probably the most effective way to rehabilitate a credit profile and boost a score is through credit building. One way we offset the effects of negative items on a credit report is through the addition of positive items. Also, not all consumers need the dispute process. We all know there are many factors that go into the makeup of a credit score, such as age, account mix, account history, hard inquiries, and debt to credit ratios. However, a good balance of credit building can aid that process. As a mortgage broker, I know I probably just made your head spin on that one, because I know it is mostly discouraged to open new accounts. The awesome thing is many of these items designed as credit builders do not pull hard inquiries, sometimes add age, lower debt to credit ratios etc. I like to call this process “massaging” a credit report. One tactic I love to employ especially with those with a good payment history but have a higher debt to credit ratio, is the authorized user trick. I know that the FICO mortgage scores (FICO 2,4,5) do not factor in authorized users, but this gives a boost to the consumer good enough for them to apply for a higher limit card of their own, instantly knocking down the debt to credit ratio without the consumer having to fork out their down payment money to pay down existing cards. Another credit builder item I love is getting things reported that they pay every month. Rent and utilities are almost never reported to the credit bureaus unless they are defaulted, then a collection agency loves to report. Rent Reporters has given my clients a 20-30 point boost on average, especially reporting 2 years worth of positive payment history. Experian has a pretty cool program called Experian Boost that reports payments to utilities. These are just a couple examples but there are many tools in my tool bag that I apply all the time to get clients where they need to be to qualify for a mortgage. I recommend many credit building resources for anyone, even if they have good credit.

Things to Look For When Seeking the Help of a Credit Repair Company

Unfortunately, not all Credit Repair or Credit Service companies are the same. I will say the industry has been tainted over the years by fly-by-night scam artists, and by larger well-known companies (“law firms” named after a city in Kentucky, or something you unlock a door with) that sting consumers along in 1 year contracts with minimal results. Here is a list of basics to look for to know you are sending your clients to a reputable company that will work tirelessly for them and you.

- Is the company registered to do business in your state and meets applicable bonding or licensing requirements? If not is that company working for a company that is (Ex: Credzu)? If the answer is No to either of those questions, then they are not legal to do business in that state.

- Are they offering you commissions for referrals, or attempting to sell you leads? In many states buying or selling leads is a prohibited practice for Credit Repair, and those in the Real Estate Industry could be looking at RESPA violations. While we cannot compensate each other, we can still work together. A good credit repair company will reciprocate and likewise send you referrals.

- Are they making lofty promises and guarantees? Not saying guarantees and promises are a bad thing, but are they realistic? Can each consumer expect a 150 point boost, or having every derogatory item deleted from their credit? Probably not, but any Credit Repair Company worth their salt screens their clients and ensures their service will actually help the client, rather than taking their money.

- Are they offering “credit sweeps”? If so run the opposite direction. Credit Sweeps involve either filing false police reports claiming ID theft to get deletions, or building a new credit profile around a new tax id or social security number. Both practices are highly illegal and can land the consumer and the credit repair company in serious hot water.

- Are they built around compliance? Compliance with laws and regulations is a must. They should not be charging in advance of performing any services. They should not employ telemarketing as a strategy (TSR is a separate topic in and of itself). My company has partnered with CREDZU which ensures my compliance, and adds more security for the client.

Links

About the Author

Sammy Dodd, Founder and CEO of Credit Wellness Solutions LLC from New Bern, NC once struggled with his credit after having 3 major surgeries and caring for his terminally ill mother. His wife, Beth who is blind also had a major surgery and dealt with an illness. Sammy took charge of his credit through research and study. He learned many of the common methods of credit repair to be ineffective and borderline unethical, through further study he met John Watts, a consumer protection attorney in Alabama, who is known for his YouTube Channel, Alabama Consumer Protection Attorneys. Through John, Sammy met Steven Palmieri who is the mastermind behind the Pre-Litigation Disputes method. Steven trains hundreds of credit repair professionals across the nation. Sammy spent months in Steven’s classes employing the strategies on his own credit profile and decided he wanted to help others improve their credit. He formed Credit Wellness Solutions that serves the entire state of North Carolina, and through his partnership with CREDZU Sammy is able to serve real estate professionals and clients in all 50 states, except Georgia.