Credit Repair FAQ

Credit Repair FAQ – In this article we are going to answer questions we get frequently about credit repair, and other questions in general. At Credit Wellness Solutions, our goal is to ensure everyone we encounter is fully informed and leaves with powerful knowledge about credit repair or credit in general whether they become a client or not. It’s time someone in the industry tackle this, might as well be me.

The Power Of Credit Building On Your Journey Of Credit Restoration (Part 4 Leveraging The Power Of Authorized User Tradelines )

In Part 4 of our series on Credit Building, we discuss the powerful too of Authorized User Tradelines. Depending on your credit profile, a well-placed Authorized User Tradeline can skyrocket your credit score.

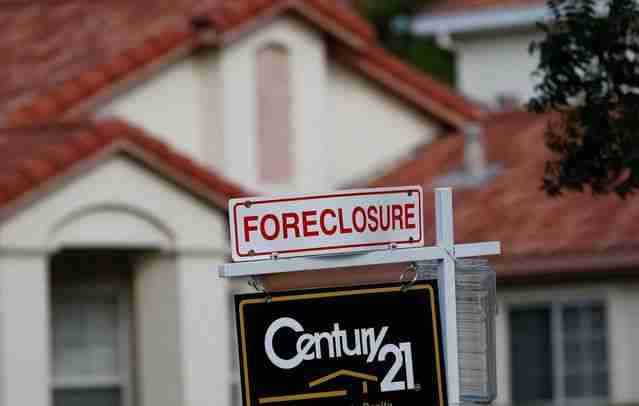

Foreclosures On The Rise – Is This An Indication Of A Cooling Housing Market?

According to data, foreclosures are up 700%. In combination with the Federal Reserve proposing interest rate hikes to combat inflation, is this hot real estate market showing signs of cooling?

Credit Repair Payment Options (Pay Per Delete vs Monthly Payments), Which of the 2 are Better?

With credit repair there are typically 2 options, Monthly Service Payments, or Pay Per Deletion. In this article we break it all down for you and explain the pros and cons of each and help you decide which of the two credit repair payment options is right for you.

Why 609 Dispute Letters Don’t Work, What Is Section 609, & How A Proper Dispute Should Look

Let’s take on the “credit repair loophole” misinformation that is widely spread all over the credit repair industry and all over the internet regarding 609 dispute letters. In this article we will show you what 609 actually is, and what a proper dispute letter should look like.

The Big 3 Credit Bureaus Disregard Of Consumer Disputes, And What You Can Do About It.

More than half of consumer complaints to the CFBP have been about the big 3 credit bureaus in the past 2 years, according to this Washington Post Article. So much so, that the Washington Post slams the big 3 credit bureaus again just 2 days later discussing why it’s so hard to get errors fixed on credit reports.

Both articles cite this report by the CFPB, detailing the deficiencies in response to consumer complaints and disputes. In the credit repair industry, we are seeing ignored or unanswered disputes, no reinvestigations, or sloppy reinvestigations. This is leaving many consumers and credit repair companies alike, scratching their heads.

Small Business Credit Repair VS Big Business Credit Repair

In this article we are going to discuss the advantages of working with your local small business credit repair company over the big, well known credit repair companies out there.

The Power Of Credit Building On Your Journey Of Credit Restoration (Part 3 Credit Building Options, Installment Accounts)

Installment accounts can be great credit builders. In this article, part 3 of our series on credit building, we discuss installment accounts and how they help you build credit, we also show you many great options you can choose from that have no credit checks! You can even save money for future use with these credit builders.

The Importance Of Credit Monitoring & Stopping Identity Theft

Identity Theft has become a huge issue ruining people’s credit. The COVID-19 pandemic has fueled this issue even more. In this article we discuss the importance of monitoring your credit, how to tell if you are a victim of identity theft, and what you can do to prevent or stop identity theft from happening to you.

The Power Of Credit Building On Your Journey Of Credit Restoration (Part 2 Leveraging Credit Building For Mortgage Approval)

Continuing our series on credit building, in this article we discuss how to leverage credit building to maximize a credit report in order to get mortgage approval. The average denial rate for a mortgage is approximately 16.1% nationwide. Denial reasons vary, but let’s tackle only the credit related reasons. Denial reasons are not limited to […]