The Power Of Credit Building On Your Journey Of Credit Restoration (Part 5 Revolving Accounts)

In out 5th and final installment of our series on credit building, we discuss how revolving accounts are the biggest asset in credit building. We also give you access to the tools we use to get revolving accounts, many with no credit checks!

First Point Collection Resources: How To Remove Them From Your Credit Report

What to do if first point collection resources contacts you Of all the debt collectors we have dealt with at Credit Wellness Solutions, First Point Collection Resources are the biggest scumbags of them all! We deal with a lot of debt collectors, but none violate the FDCPA with no regard or remorse like First Point […]

DIY Credit Repair – Can You Fix Your Own Credit?

When it comes to DIY credit repair, there are a plethora of resources online. Some things involve a book, dispute letter generator, a software that promises you ownership of your own credit repair business that will make you millions in a very short time to the countless “609” dispute letter templates. Today we discuss your options to fixing your own credit.

Disturbing News For The Housing Market

Unfortunately, the changes we were thinking we were going to see in the housing market are beginning to take shape. With demand still high, what can you do to weather the upcoming storm?

Who Is SCA Collections? How To Remove SCA Collections

If you live in the tidewater region, chances are you have heard of SCA Collections. Perhaps you have gotten letters from them, or seen them on your credit reports. In this article we will show you how to deal with them.

Credit Repair FAQ

Credit Repair FAQ – In this article we are going to answer questions we get frequently about credit repair, and other questions in general. At Credit Wellness Solutions, our goal is to ensure everyone we encounter is fully informed and leaves with powerful knowledge about credit repair or credit in general whether they become a client or not. It’s time someone in the industry tackle this, might as well be me.

The Power Of Credit Building On Your Journey Of Credit Restoration (Part 4 Leveraging The Power Of Authorized User Tradelines )

In Part 4 of our series on Credit Building, we discuss the powerful too of Authorized User Tradelines. Depending on your credit profile, a well-placed Authorized User Tradeline can skyrocket your credit score.

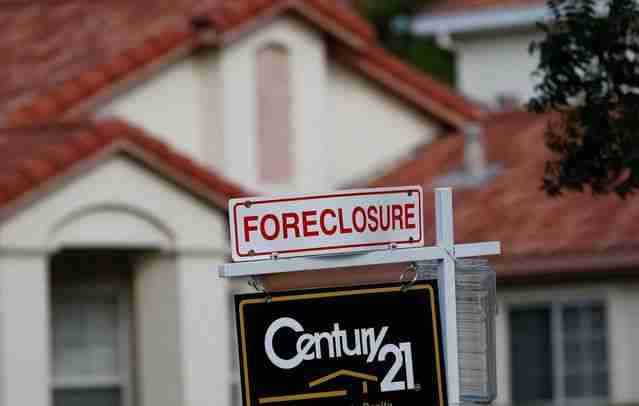

Foreclosures On The Rise – Is This An Indication Of A Cooling Housing Market?

According to data, foreclosures are up 700%. In combination with the Federal Reserve proposing interest rate hikes to combat inflation, is this hot real estate market showing signs of cooling?

Credit Repair Payment Options (Pay Per Delete vs Monthly Payments), Which of the 2 are Better?

With credit repair there are typically 2 options, Monthly Service Payments, or Pay Per Deletion. In this article we break it all down for you and explain the pros and cons of each and help you decide which of the two credit repair payment options is right for you.

Why 609 Dispute Letters Don’t Work, What Is Section 609, & How A Proper Dispute Should Look

Let’s take on the “credit repair loophole” misinformation that is widely spread all over the credit repair industry and all over the internet regarding 609 dispute letters. In this article we will show you what 609 actually is, and what a proper dispute letter should look like.