What’s Happening At Credit Wellness Solutions?

A lot is happening at Credit Wellness Solutions. We are nearing the final stages in our first few client’s credit repair journey. Our first client started with credit scores in the low 500’s, now they are about to break into 700 club, and about to close a construction loan for their very first home! Our good friends at Factory Direct Modulars is building their home, and we recommend you check them out! Other clients are nearing the stage where we audit their credit reports 1 last time. If the errors we disputed are

still reporting, we will be filing arbitration against those creditors to pay our clients for their errors, and delete their items from our client’s credit reports. Those clients, by simply listening to our pointers to improve their credit have both enjoyed 60-80 point increases in their credit scores! We have already recovered $6,000 in Debt Collection Violations (FDCPA), and another $1,000 pending litigation. Keep reading to learn how you can get paid to fix your credit, or click the button below to learn more.

How Can You Get Paid For Fixing Your Credit?

The Big 3 credit bureaus want you to believe that credit reports are 97% or greater accurate. Think again! Credit reports are loaded with errors. I’ve said this before, and I will shout it from the rooftops, I have never seen an accurate credit report! If you ask me the 97% or greater statistic

is the actual rate of errors. According to the Fair Credit Reporting Act (FCRA), Items on a credit report must be reported to “maximum possible accuracy”. In order to meet this mandate, the credit industry developed a Universal standard of reporting, called Metro2. This means that account data is submitted once per contract period (typically monthly) via the same system to each bureau the account is reported.

How Errors Are Discovered

Knowing the facts above, one of the ways we find errors is by finding inconsistent or conflicting data being reported between the 3 bureaus. So for example, if one bureau is reporting an account open date of 8/10/2012, then the other 2 should be reporting the very same date. Often time, we find at least one bureau reports the date differently. We also find that the same account is reported 3 different ways.

Another thing we find are conflicts in the way the account is reporting on the same bureau. For example, the payment status could be reporting as 30-days late, but when you look at the payment history section (the section with all the checks or x’s), the account is marked on-time. Another thing we commonly find is physical impossibilities. In the payment history it will show an on-time payment followed by a 60-day late payment the next month. Well, last we checked 1 month is at most 31 days. So, how can you be 60-days late if you were on-time the month prior?

Finally, we look for missing data. If there is a field showing on the credit report and it is missing data we notate it. That field could be showing data on one of the other reports, or missing from all 3. Then we look at the account type and the account status to determine if the field of information applies to that account. How do we know if the information applies or not? Don’t tell your creditors, or the credit bureaus, but we have the Metro2 manual, and know how accounts are supposed to be reported! We take this knowledge and leverage this for you!

How We Dispute Discovered Errors

We simply highlight each error, with questions and explanations and send to all 3 credit bureaus certified mail. We wait 45 days to receive all results. Then we audit the credit reports again. We then dispute the errors that were not fixed the same way, except we now send the creditor a dispute in addition to the credit bureaus. We wait

another 45 days to receive results in the mail. Then we will audit the credit reports one final time. Remember I mentioned that any account that reports on a credit report has to be reported to “maximum possible accuracy”? Well, the FCRA also says anything that reports has to also be verifiable. So if there are still errors remaining after disputing them on more than one occasion, then there is a serious problem. Below is an example of what one of our disputes looks like.

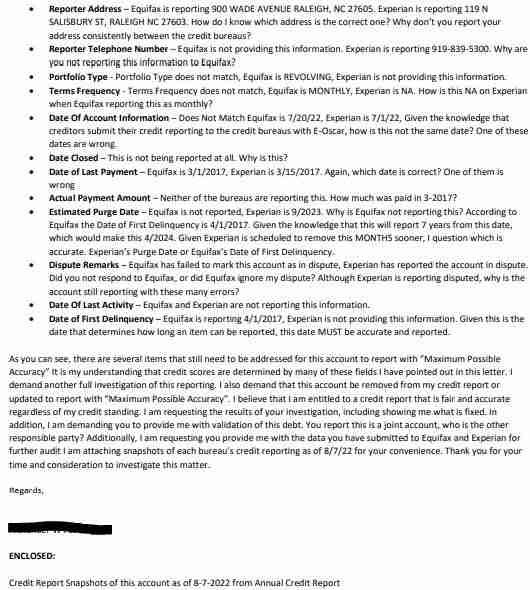

Example Of Our Disputes

As you will see below, our disputes are very detailed. We point out every inconsistency, conflicting information, and missing data fields. In the example below we used 16 bullet points of errors. Some bullet points contain multiple errors! This example was addressed to the creditor as a 2nd round dispute, so this means all these errors were found after a prior dispute! Client information has been redacted for their privacy.

In addition to the dispute letter, we also include a full copy of how the account is being reported, so there is no excuse to why the account was not fixed or deleted from the credit report. Each letter is tailored to build a case for litigation, or arbitration. They clearly show what the errors are, and what needs to be fixed.

How Our Disputes Can Help You Get Paid To Fix Your Credit

Think of our disputes like a teacher giving their student the answer sheet to the big test. They show everything that needs to be fixed to report to “maximum possible accuracy”. If the errors remain on the credit reports after giving them multiple opportunities to fix or delete the account, then we have successfully built a case for arbitration, or litigation. This is why we call it Pre-Litigation Credit Repair. Not only should we

successfully prove that the account was reporting with errors, we also prove that the credit bureaus or creditors were negligent in following the FCRA’s mandate of “maximum possible accuracy”. The FCRA also states that the creditors and credit bureaus must have “reasonable procedures” in place to conduct a “reasonable reinvestigation” of a consumer’s dispute. With the account still reporting with errors, our dispute also shows that the procedures failed, the reinvestigation was botched, or that they blatantly disregarded the law and ignored the dispute.

This is why we say we can help you get paid to fix your credit. According to the FCRA, you are entitled to damages (compensation) if the credit bureaus and creditors do not fix errors, or delete the account because accounts reported on your credit must be reported to “maximum possible accuracy” and “verifiable”. Not only can you get compensation for these violations, you can get these accounts deleted from your credit report. This is why we say that our Pre-Litigation Credit Repair Methods can help you get paid to fix your credit.

When Results Matter, Trust Credit Wellness Solutions

Unlike other credit repair companies, even large national companies that claim to be “law firms” our disputes are thorough. We do not use cookie-cutter template letters, 609 dispute letters, or non-factual claims in our disputes. Our Pre-Litigation disputes build a case for you! If your account is not fixed or deleted, we are with you every step of the way. In cases where arbitration is warranted, we represent you. This can pay you for those errors, reduce, or even pay off your debt. Either way, we help you get paid.

In larger cases, we are backed by an extensive network of consumer attorneys ready to take your case to the courtroom. This costs you nothing as the credit bureaus, creditors, or debt collectors will be responsible for all attorney fees.

To get started, simply click the button below to request a free consultation. We can’t wait to serve you, and help you get a fair, accurate, and healthy credit profile you deserve.