Personal Credit VS Business Credit

The difference between personal credit and business credit is more than you think. In fact, both forms of credit are 2 entirely different animals. Although symbiotic in relationship, you can have personal credit without business credit, but you can’t have business credit without personal credit. Buckle your seatbelt today. This is going to be a wild ride!

1. Personal Credit And Business Credit Are Obtained Differently

Personal Credit Is Easy To Get

The main difference is how you get credit. Personal credit is easy to get, you simply apply for the type of credit you want, and depending on your past credit history, credit score, and your income will determine if you get approved.

Business Credit Relies Heavily On Your Personal Credit

Business credit is a whole different animal. You aren’t going to go to your bank and walk out with a large loan to start a business. Although, a high personal credit score may give you that opportunity, you will likely have to build your business credit from scratch. Your personal credit will have a huge impact (initially) on your ability to obtain business credit. Lenders want to see 2 things, if you will repay them, and/or if they will receive a return on their investment. If your personal credit score is below 700, you are likely to get declined for a business loan or a business credit card.

2. Business Credit Is Built Differently

The Small Business Administration (SBA) did a great write up on how to get started. Click Here to read it. The first thing to understand, Business Structure is key. Sole Proprietors will NOT be able to have business credit separate from personal credit. Sometimes, you can build business credit

based on you company’s EIN Number (Tax ID), or the company’s sales and income without needing to look into your personal credit. In a lot of situations, your personal credit may also be checked. However, if your structure is an LLC, if you build business credit, it will be under your company so should it default, it will not affect your personal credit. Also, you will need to get a DUNS number from Duns & Bradstreet. We have a couple tools to help you build business credit we will discuss later in this article. If you would like to get started building your business credit, click the button.

3. Business Credit Accounts Are Different Than Personal Credit Accounts

In personal credit, you essentially have 2 types of accounts. Revolving Accounts, or Installment Accounts. There are types of other accounts for many situations, however they still fall into one of those 2 types of accounts. In business credit, you have 3 tiers of accounts. Let’s Discuss them here.

Tier 1 – Basic Trade Accounts (Net 30’s)

Tier 1 involves your everyday charge accounts such as, rental of office supplies, utilities, work supplies such as construction materials.

Tier 1 accounts are the easiest to get. In most cases, your personal credit is not checked. A good payment history on those accounts can get you into tier 2 and tier 3.

Tier 2 Advanced Trade Accounts Or Capital Loans

Tier 2 accounts are typically working capital loans or a type of business funding loan. Personal credit and business credit can be checked, but these loans are typically based you business sales and volume. So it is hard for entry level businesses to access tier 2 credit until they are established and doing steady business. Business credit cards are also considered tier 2 business credit.

Tier 3 Large Bank Loans

Tier 3 accounts are the cream of the crop as far as business credit accounts. This is where you find loans for heavy equipment, and other larger loans funded by banks. Tier 3 credit may require a check of your personal credit and business credit.

Building Business Credit Rapidly

The good news is you can build your business credit pretty fast. In fact, we have solutions that can take you straight to tier 3! Net 30 accounts are very easy to get. So you should always try to get some Net 30 accounts reporting on your business credit reports. It’s one of the fastest ways to move into tiers 2 and 3 without the credit building tools we are about to show you. Here are those options.

Credit Strong (For Business)

Credit Strong for business works the same as their personal credit building program. They open a savings account for the amount desired that you make monthly payments on until you paid it off, then the funds in the savings account is yours. This will report as a tier 2 installment loan to Equifax, and Paynet. They will report to more credit bureaus in the near future. Simply click the BUSINESS tab on their website to sign up.

GCL Credit – Instant Tier 3 Credit

Our Friends at GCL Credit have knocked it out of the park with this business credit building resource! This by itself will take you straight to tier 3! This is a business authorized user tradeline that will report on the 4 business credit bureaus (Experian, Equifax, Dunn & Bradstreet, and Lexis Nexus). They will be paid and closed accounts with a minimum of 2 years flawless payment history. Once this hits your reports, you can apply directly with the lenders of your choice. This is truly a game changer for those with no business credit, or those still trying to build tier 1 and 2 credit.

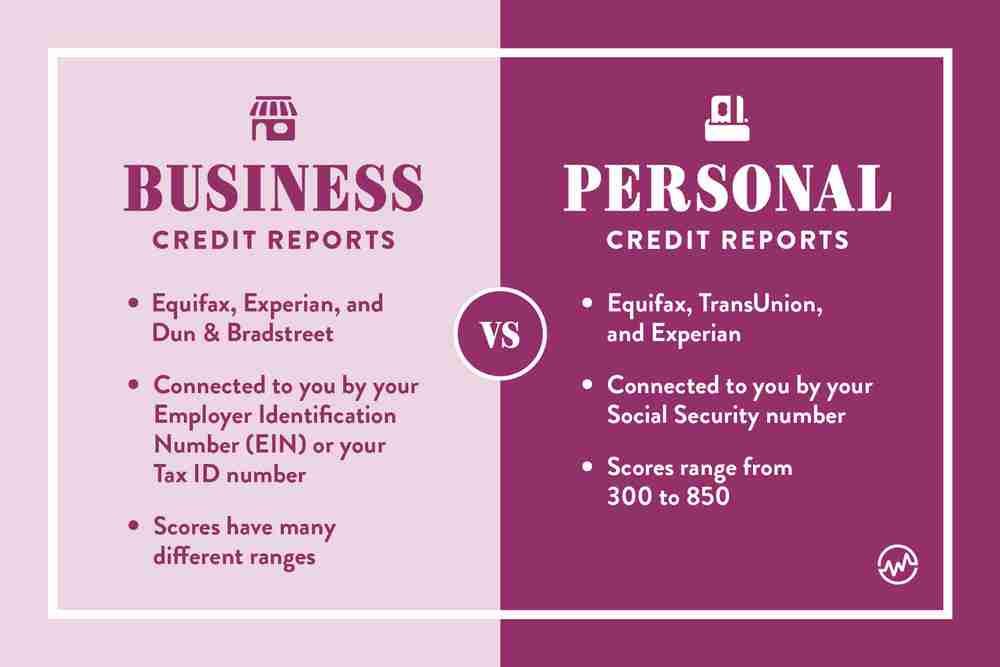

4. Personal Credit And Business Credit Report To Different Credit Bureaus

Of course, there’s major differences in how your credit is reported. Here’s a summary of the differences between personal & business credit.

Personal Credit

- Reported on Equifax, Experian, and TransUnion

- Credit Scores Range From 300-850

- Identified With Social Security Number

Business Credit

- There are many including, Duns & Bradstreet, Equifax, Experian, Lexus Nexus, and Paynet

- Credit Scores are different per bureau

- Identified with your EIN, or Tax ID (If LLC or Corporation) Social Security (if Sole Prop)

5. Credit Reporting Laws And Your Rights Are Different

Personal Credit

In the world of personal credit, credit reporting, debt collection, and consumer disputes are all governed by the FCRA, and in cases of debt collections, the FDCPA. Consumer’s have clearly defined rights, such as the right to a credit report with “maximum possible accuracy”. You also have clear rights to dispute anything you believe is inaccurate in your credit report, and the right to hire a credit repair company (except in Georgia) to help you fix your credit. Click the button below to schedule a Free Credit Consultation.

Business Credit

Unfortunately, business credit being the different animal that it is, does not enjoy the same protections you enjoy as a consumer. Often, disputes are settled in court, and although there are some business credit repair companies out there, more than likely your best bet is to start fresh with some business credit building.

Final Thoughts

As you can see, in the world of credit, personal credit and business credit are 2 entirely different animals. Knowing how to navigate both of them will be crucial for you if you need to use credit in your personal or your business life. Credit Wellness Solutions is here for you every step of the way. Don’t hesitate to hit the button to schedule a consultation. Thanks for reading!