Let’s take a deep dive into credit scores, shall we? It may seem like a shock, but the score your lender sees may not be the same thing you are seeing in Credit Karma, Smart Credit, other credit monitoring services, or even the credit bureaus’ websites. There isn’t just 1 credit score, there are countless credit scores. However, they all share one thing in

common. Every score is a computer program that looks at your credit report and based on certain factors in the data on your credit report. The score you see on Credit Karma could be as much as 60-80 points higher than what your mortgage lender is seeing when they check your credit report. Why is that? Let’s take a deeper look into why, and what we can do to ensure your scores are as high as they can be.

Why So Many Scores? Credit Scores Explained

There are 2 main credit scoring companies, FICO and Vantage. Banks and lenders may also have their own proprietary scoring model as well, Navy Federal is a good example. FICO has 10 versions, but then each version may have variations by credit bureau, or by lenders. So even though there are 10 versions of FICO, there are actually hundreds of FICO scores.

Vantage has 3 versions of their scores. Similar to FICO, Vantage has custom versions for the credit bureaus and lenders. That’s a lot to wrap your head around. No one fully knows either company’s secret sauce to know exactly how their scores are generated. But there are many general rules of thumb that applies to both scoring models that you can learn to get the most out of your credit reports.

How To Maximize Your Credit Scores

If you have ever tracked a hurricane, especially if you are like us at Credit Wellness Solutions, living on the coast of North Carolina, then you know about the spaghetti hurricane forecasting models. Those many lines tracking the potential path of the storm. Forecasters look at where the majority of where the lines agree and draw a cone around them, called the cone of uncertainty.

You may not be at the exact location where one of the forecasting models predicted, but you know that if you live inside that cone of uncertainty, you are going to feel something from that storm. Improving your credit scores works the same way. It’s not so important knowing how many credit scores there are, but knowing what those credit scoring models are looking for, and what you can do to take advantage of it.

1. Know What’s On Your Credit Report

Knowing what’s on your credit report is more important than knowing how many credit scores exist, or even knowing how they are generated. Are all the accounts yours? Is the information accurate? The truth is, like going to the doctor for regular check-ups and lab work, monitoring your credit report is the single most important thing to do! Credit monitoring can alert you to credit

report changes as they happen. It can help you stop an identity thief from tanking your credit scores, and help you see your progress on your journey to a healthy credit profile. Many services exist. While we will always say any credit monitoring service is better than none, we highly recommend steering clear of the popular free services like Credit Karma as they do not provide enough data to ensure accuracy. Click the button below to get better credit monitoring, so you know if the information is reporting accurately. We use these services here with our clients at Credit Wellness Solutions.

2. Get Inaccurate Items On Your Credit Report Removed Or Corrected

Credit scores are generated by the information on your credit report. Inaccuracies, such as a 60-day late payment next to an on-time payment (we see this all the time), cost you more points on your credit score than if it were reported correctly as a 30-day late. Inaccurate information, even if it only affects your score by 5-10 points can cost you thousands in interest, or even your ability to

qualify for a loan, a job, or even to rent an apartment. We have yet to see an accurate credit report. In fact, if you read some of our other articles, we believe an accurate credit report does not even exist. Disputing inaccuracies is our specialty. So much so that we build a case for you to either arbitrate against your creditors, or sue them if the inaccurate items are not deleted or corrected. Even better, you could get compensated for those errors as well. Click the button below to learn more about the Pre-Litigation Credit Repair process, and schedule your FREE consultation with Credit Wellness Solutions.

3. Know The Credit Scoring Factors, And Capitalize (Credit Scores Explained)

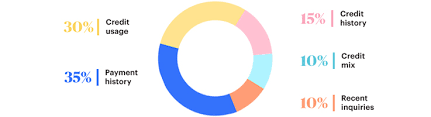

The most important thing to know about credit scores, is knowing how your scores are generated, and adjust your credit profile, and your habits to maximize your credit score potential. Although there is no exact science, pictured above is a general rule of thumb that will at least draw a “cone of uncertainty” like our hurricane forecast reference earlier.

Payment History (Roughly 35%)

Payment History is the largest factor in credit scoring. The credit scoring models are not only looking to see if you are paying on your debts, but also if you are paying them ON TIME. Of course your most recent payment history will have the bigger effect, Although you might not be able to change your past (unless you employ some credit repair), you can change your present and future by simply paying on time each month. Budget appropriately, set reminders on your phone, use autopay, whatever you have to do to ensure your payments are made and made on time.

Credit Utilization (Roughly 30%)

Of course the credit scoring models, and especially your creditors want to see you using your credit, but the credit scoring models look even deeper to ensure you are using your available credit responsibly. The general rule of thumb is to keep the balance of your available credit below 30%. (ex: Card Credit Limit = $1,000, the max you want charged on that card is $300) This applies to individual accounts and the sum of all your accounts combined. The scoring models love to see it even lower, say around 10% or less to maximize your credit scores. One strategy you can implement now is to pay down your current obligations, and always pay more than the minimum payment.

Average Age Of Accounts (Roughly 15%)

This one is pretty self explanatory, the older the average age of accounts on your credit file, the better. This is why credit experts always advocate to keep your lines of credit open. For instance you may get a Fingerhut account and not use it, in order to keep it open buy something small and pay it off. You never want to close old accounts as it lowers your credit age, thus reducing your credit score. If you are just starting out, or rebuilding your credit, we can show you a neat trick to add age to your credit file.

Mix Of Credit Account Types (Roughly 10%)

This one is also self explanatory. The scoring models, and lenders like to see how you manage multiple types of credit. They don’t like to see all credit cards, or all loans. Try to diversify your accounts. We typically

Credit Inquiries (Roughly 10%)

Inquiries are most talked about but have for the most part the least impact. After 1 year their effect diminishes, and Of course, we recommend not apply for credit unless you need to. Watch this video for pointers about avoiding hard inquiries, especially when applying for a big purchase like a car or a home.

As you can see, simply changing some habits, and using the credit scoring factors, you can use these to your advantage to build a healthy credit profile, and raise your credit scores significantly! In our next point we will show you how to use credit building to capitalize on the credit scoring factors to make the most out of your credit report.

4. Use Credit Building Products To Help

Credit Builders can be a powerful asset if you are lacking any of the credit scoring factors. In fact credit building is a credit repair company’s most powerful tool in the toolbox. So powerful that credit building can be more effective than the credit repair process if strategy is sufficiently

planned. For example, if your credit card utilization is a little high, you can add another revolving account from our credit building products as most do not check your credit, which will keep an inquiry from appearing on your credit report. You can also try an authorized user account to do the same, plus you can get the added bonus of an older account.

Credit building is our passion at Credit Wellness Solutions. Click the button below to schedule a free consultation. We will analyze your credit report and give you a game plan to boost your credit as much as possible. We also help young adults establish their credit for the first time. Parents can use this to get their older teens off to a head start to an awesome credit profile.

You can also visit our credit building products page to see what there is to offer, and choose the credit builder that best fits your needs. Click the button below to visit our credit building page.

5. Avoid Debt Collections At All Costs

Debt collections can put a major damper on your credit scores. Not to mention the stress of their constant letters and harassing phone calls. A new collection on your credit report can push your credit scores down over 40 points. Here’s a few tips to avoid collections.

Medical Collections

In recent months medical collections have new credit reporting rules that you can leverage in your favor. In July 2022 the 3 major credit bureaus announced that medical collections under $500 would no longer report on your credit report. This is great news that you can use in your favor. If you receive a medical bill that you cannot afford to pay, at least pay it down to $499.99 until you can pay it off. This way if your file gets sent to a debt collector, THEY CAN’T REPORT IT. Also, if you do have a medical collection sneak on your credit report, Pay it off. Paid medical collections are automatically deleted.

Collections On Other Types Of Accounts

Unfortunately, the breaks you get from medical collections do not apply, so it is important to know how to avoid these collections. To begin, most people with other types of collections are either surprised by them, or remembers a time they were frustrated with the original creditor and refused to pay (such as a fee after you moved out of a rented home). Be sure to pay your debt obligations, even if you have to make special arrangements or small payments. Also, if you move, be sure to turn in your cable box, and pay the final utility bills. Be sure you have mail forwarded to your new address so that you receive those bills.

What To Do If You Receive A Collection Letter

Contact Credit Wellness Solutions immediately! We can help you prevent it from reporting on your credit, and if it does report, help you get it removed. Debt Collectors stop at nothing to get paid. So much so, they violate the laws that govern debt collections to intimidate you into paying them. In fact, the collection letter in the mailbox could be in violation in and of itself. Credit Wellness Solutions knows how to hold

debt collectors accountable, and help you get your credit scores back up. The Fair Debt Collection Practices Act (FDCPA) governs all debt collectors. If they report to the credit bureaus, they are also governed by the Fair Credit Reporting Act (FCRA). Violations of the FDCPA can be worth up to $1,000 per violation. Violations of the FCRA can be worth even more!

FDCPA Violation Examples

- Improper Dunning Notices – There are rules on what must be in a collection letter, including the name of the original creditor, and how you can dispute or question the debt.

- You can tell the letter came from a debt collector. Having their name or logo printed on the outside of the envelope, or being able to see words through the envelope is also a violation.

- Contacting you after they are told not to.

- Threatening jail, wage garnishment, etc.

- Making false representations, or things that should be known to be false, including inaccurate credit reporting.

- Failure to mark a disputed debt as disputed on a credit report. This can affect your credit scores because the credit scoring models do not put as much weight on debts that are disputed.

Protect Your Credit Scores From Debt Collectors With Credit Wellness Solutions

Credit Wellness Solutions offers a debt collection audit service that can help you hold debt collectors accountable. We can help you get debt collections deleted, or prevent them from reporting on your credit report and reeking havoc on your credit scores. We uncover debt collection violations and help you get compensation for

those violations. For a 1-time initial audit fee, you get 2 years of protection from debt collections. If we uncover violations, we will forward your case to our extensive nationwide network of attorneys ready to take your case. Each violation can pay you up to $1,000 per violation. Even if we don’t find violations, we can help you prevent the collection from reporting, and help you dispute the collections until they are removed from your credit reports. Click the button below to hold the debt collectors accountable, and protect your credit scores.

Never Give Up, Be Patient

Most people who fail give up just before they are about to experience the breakthrough to achieve their goal. The journey to the 800+ credit score club takes years. The credit repair process also takes time, and can honestly be very frustrating at times. The main point we want to make is, no matter where you are at in your journey, whether it’s credit repair, credit building, or maintaining your credit by ensuring you are inside the “cone of uncertainty” with the credit scoring factors, it takes time to reach the top. Stick it out and keep pushing. You will thank yourself in the long run.