Millions of Americans seek debt relief every year. Unfortunately, scammers know this and take advantage of it. Debt settlement scams are rampant in our nation, even more rampant than credit repair scammers. We want to show you the warning signs, and help you steer clear of them. Also, we want to show you powerful

ways to become debt free. Also, since Credit Wellness Solutions is based in North Carolina, we are going to discuss debt settlement in North Carolina, and help North Carolina consumers find reputable debt settlement. Finally, we will discuss the relationship of credit repair to debt settlement, and how if combined properly, can help you become debt free and have a better credit profile.

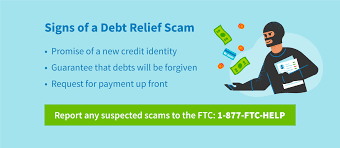

The Signs Of Debt Settlement Scams

The Federal Trade Commission, and the Consumer Finance Protection Bureau field many complaints about debt relief or debt settlement (the same thing). Here is a list of warning signs that you may be dealing with a scammer.

- They Do Not Hold The Proper License Or Certifications – Most states require some sort of license or certification to practice debt settlement. Ask for proof, and if they cannot produce it, you are likely dealing with a scammer. As a side note, some legitimate credit repair companies do this as well, but no matter how good their intentions are, they also must hold these licenses to practice.

- They Promise Improved Credit Scores “Over Time” – Most debt relief or debt settlement scams involve the salesperson promising improved credit scores over time. This can be somewhat true if your credit profile has nothing but charge-offs, but many who seek debt settlement are either behind or in danger of being behind on their debt. Most of the time credit scores will tank because they will tell you to stop making payments to your creditors allowing your accounts to be charged-off. This hurts the credit score. Settling the debt will improve your score slightly, but not much, and the negative tradelines will remain on your credit report for 7 years.

- They Claim Settled Tradelines Are Positive – This is a half-truth. Although it is far better than a charge-off, a settled tradeline on your credit report is still a negative item and will negatively affect your credit score for 7 years.

- They Claim You Cannot Settle A Debt Without Professional Help – This is far from the truth. In fact, you can settle debts on your own. We recommend our clients to settle their debts all the time and help guide them through the process (we do not do it for them, not yet anyway).

- They Claim They Can Negotiate Better Settlements – While it is possible to get settlements as low as 20% of what is owed, many debt relief or debt settlement scams claim this will be done every time. Truth is, the representative of your creditors have certain policies their company makes them follow. Typically, you can expect to settle a debt at 35%-60% of what is owed.

- They Will Leave The Consumer High & Dry If The Creditors, Debt Collectors, Or Debt Buyers Sue – Debt relief and debt settlement scammers will not tell you that even though you are in their program you can still be sued for unpaid debts. Some companies do offer legal assistance, or for an additional fee, pay an attorney a retainer to defend you if this happens.

- The Image Above – Creating a new credit identity is called a “credit sweep” and should be avoided at all costs. Likely, unpaid debts will not be forgiven. At best you will get a 1099-C which makes you liable for taxes on unpaid debt. Never pay upfront for debt settlement, debt relief, or credit repair. It is illegal for any of them to charge you in advance of service.

- They Will Rapidly “Graduate” You In A High Interest Debt Consolidation Loan – After paying for a good while without many debts being settled, they will use the money you have built up in escrow to magically graduate you from the program into a debt consolidation loan with absurdly high interest. This leaves you still paying on the debt, with a bad credit score, negative items on your credit report, and laugh all the way to the bank that pays the company a fat commission check.

Debt Settlement In North Carolina

North Carolina has different laws regarding debt settlement than most other states. To begin, in order to practice debt settlement in North Carolina, the company and its employees must be certified by a national source as credit counselors. They must not charge more than $40 as a setup

fee, and must not charge you more than $40 monthly in fees to service your account. Non-Profit organizations and Attorneys are exempt. Anything other than this is illegal. Many of the national debt settlement scams get around this by getting their employees certified, but they charge hidden fees, and do not provide any real credit counseling. Credit Wellness Solutions, based in North Carolina is in the process of becoming certified and will provide credit counseling, credit repair, and debt settlement once completed. Until then, we can help you fix your credit as we are credentialed to provide credit repair.

The Powerful Combination Of Credit Repair And Debt Settlement

Credit repair and debt settlement complement each other very well. You see, many credit repair companies won’t tell you that even if they get negative unpaid debts off of your credit report that you still owe the debts. You can also still be sued for the debt if it is within your state’s statute of limitations. Debt settlement companies often do their thing leaving negative items on your credit report. What if credit repair and debt settlement companies worked together, or get licensed to practice both credit repair and debt settlement? Having credit repair after debt

settlement is the perfect complement to not only becoming debt free, but to improve your credit report after the settlement process is a sure way to ensure you financial health and future. We at Credit Wellness Solutions are endeavoring to become certified to practice debt settlement. Until that time, we can guide you in the process to settle your debts on your own, and help you budget for it. Schedule a Free Consultation with us to find out how we can help you improve your credit, and guide you to become debt free.

How To Become Debt Free On Your Own

You can become debt free on your own without having to hire a debt settlement company. All it takes is a change of mindset, a goal, and a good plan. Below you will find tips and tricks to get out of debt. We must caution you to realize that paying off debts will make some impact on your credit, but only in certain conditions will it make any measurable improvement in your scores.

If you are dealing with charged-off accounts, paying them or settling them will improve your credit, but still leave a negative item on your credit report. If your debt is not a charge-off or a collection, then paying off the debt could actually hurt your credit, especially if you close a long-time credit card. Look at the pointers below and schedule a consultation with us if you would like guidance in improving your credit and becoming debt free.

- Review Your Expenses And Income – It’s hard to make a budget if you don’t know how much is coming in and going out. Sit down. Study your bank account and find out where your money is going.

- Trim The Fat – After you see where your money is going, cut the waste. What can you live without? Do you really need to eat out 3x a week? Do you really need that Netflix subscription? Cut the waste from your spending, you will be surprised how much money you really do have.

- Make A Budget To Begin Working On Your Debt – Budget your expenses. Spread out and save up for your monthly payments.

- Go After Low Hanging Fruit First – Find your smallest debts, and work to pay those off first.

- Tackle The Big Boys – One of the best ways to handle larger debts is to make extra payments and pay more than the minimum payment. This will help you pay off the bigger debts faster, and you will save money in interest saved by paying extra.

We hope this guide on avoiding debt settlement scams and how to become debt free was super helpful. At Credit Wellness Solutions we strive to become a complete service to help our clients enjoy financial freedom, becoming debt free, and having a credit report and credit score that reflects a financial soundness. We want to help you achieve your dreams. Schedule a Free Consultation today, and see how we can help you with all things credit.