The only thing standing in the way of you and a good credit score, is knowing how to identify credit reporting errors and that to do about it. Inaccurate credit reporting cost consumers THOUSANDS in interest, and can even cost you an approval or denial for a loan for a large expense, such as a mortgage or a car loan. One of our attorney partners, Cardoza Law Firm wrote a blog article about this very topic.

The FTC reports that 1 in 5 people have significant errors on their credit reports. Personally here at Credit Wellness Solutions, we have NEVER seen an accurate report, in fact, we believe an accurate credit report does not exist! If you feel you have inaccuracies on your credit report and want to do something about it, click the button below to schedule a Free, No Obligation, Consultation with us. We can analyze your credit report and show you inaccuracies, and even estimate how much it could potentially be affecting your credit score. If you would like to learn how to identify them yourself keep reading.

How to identify credit reporting errors: getting the right credit reports

Why credit reports from credit monitoring services won’t cut it

While we believe credit monitoring is something we recommend for everyone to have, services like Smart Credit, Credit Karma, Credit Sesame, and My Score IQ (to name a few) are not suitable for auditing for errors, nor disputing. This is because credit reports from these providers do not provide all the fields that are in a credit report, and are

likely to be missing information. Also in a court, a lawsuit that is based on disputes that were drafted using credit monitoring reports are treated as hearsay because the reports did not come straight from the source, which is the credit bureaus. Although, credit monitoring does still give you an indication you may find inaccuracies and keep tabs on your credit score, it is still an essential service everyone should have. Click here to see the services we highly recommend. We have written in more detail on this topic on our blog here.

How to get credit reports directly from the credit bureaus

You have 2 options to get your credit reports from the big 3 credit bureaus. You can either go directly to each credit bureau’s website and register for an account, or the SIMPLEST way is to go to AnnualCreditReport.com and get them there. We like ACR better because you can print or save the reports and compare them side-by-side. Click the image below to get your credit reports from ACR.

How to identify credit reporting errors: How to read your credit report

Credit reports come in many formats, even the same bureau may have different formats you can view or print. However, the credit reports have one common theme, which is Metro2. Metro2 is the credit industry’s universal standard for reporting consumer credit information. Although credit reports may look different amongst the credit bureaus or even the same credit bureau, they all report the same information. Metro2 was created by the credit reporting industry to meet the mandate of “maximum possible accuracy” in the Fair Credit Reporting Act (FCRA). We will go deeper into Metro2 later in the post but for now let’s look at some examples of what credit reports look like from each bureau.

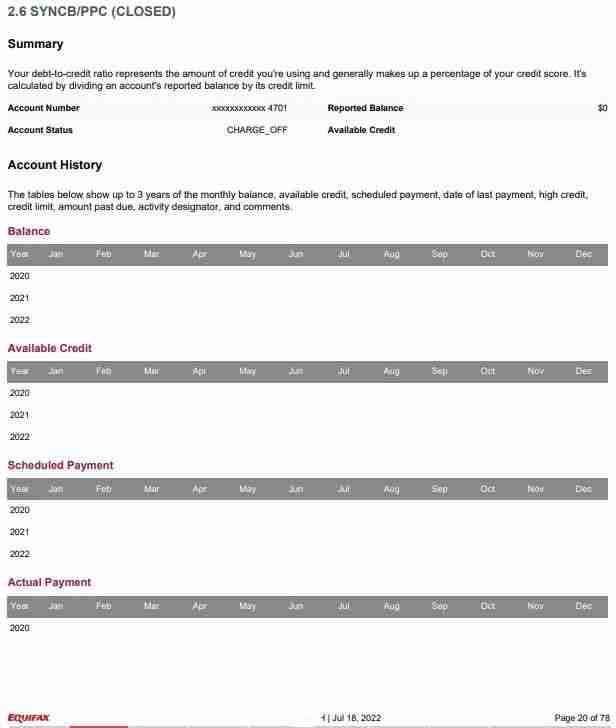

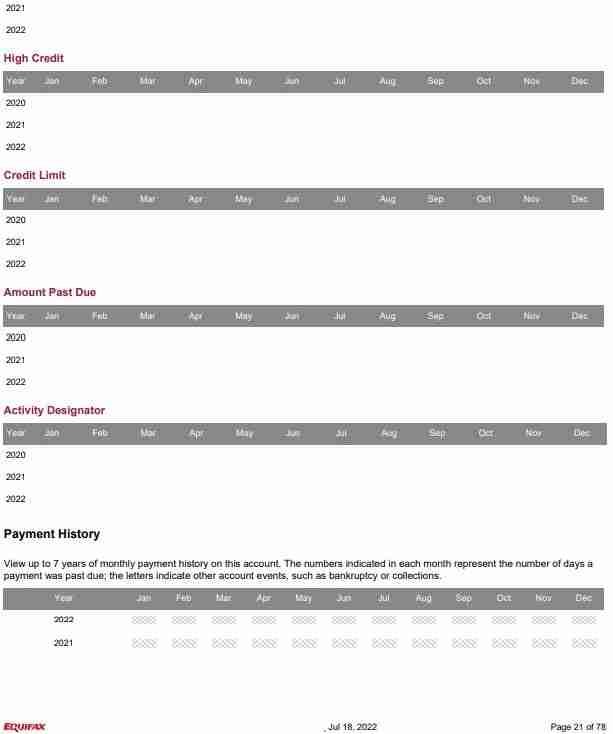

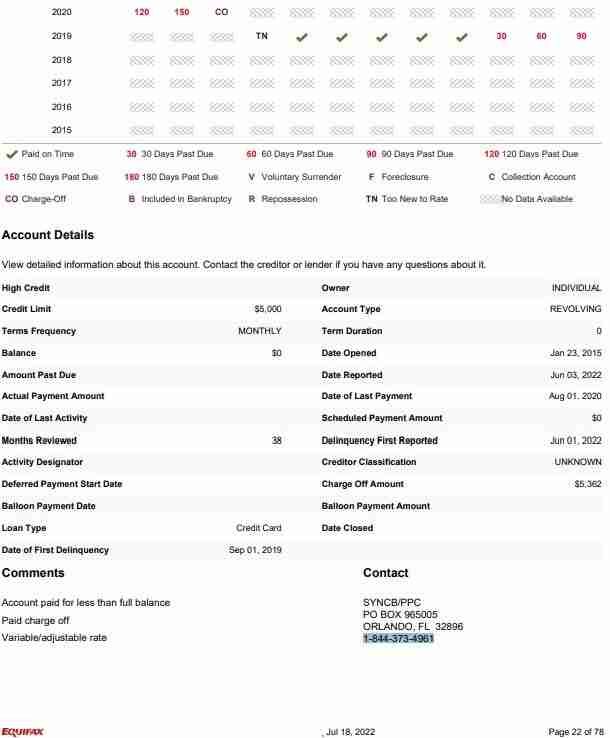

Equifax Examples

Below are examples of credit reports from Equifax. These are examples of what you will see from Annual Credit Report, and My Equifax, which is Equifax’s service for providing credit reports.

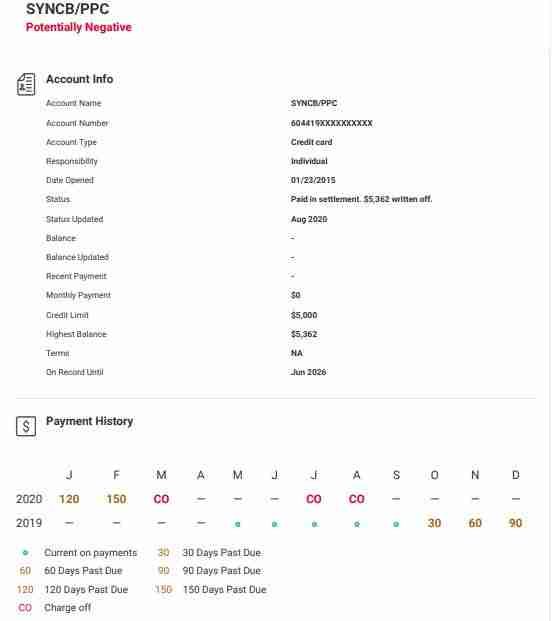

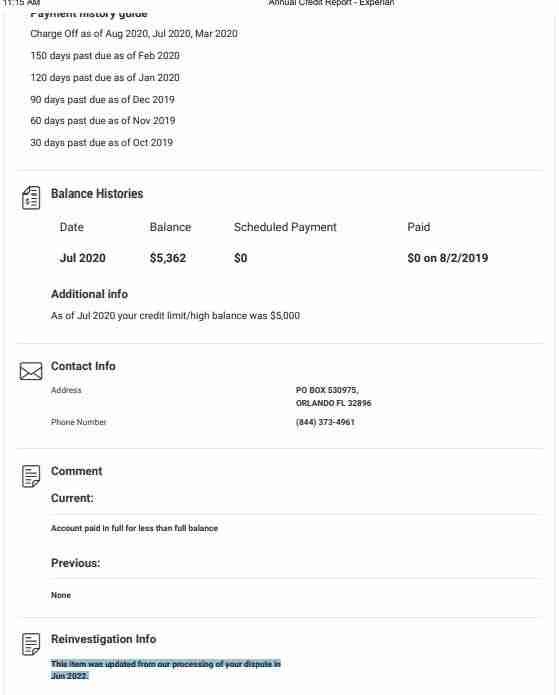

Experian Examples

Below are Experian Examples From Annual Credit Report. Reports directly from Experian’s website display similar.

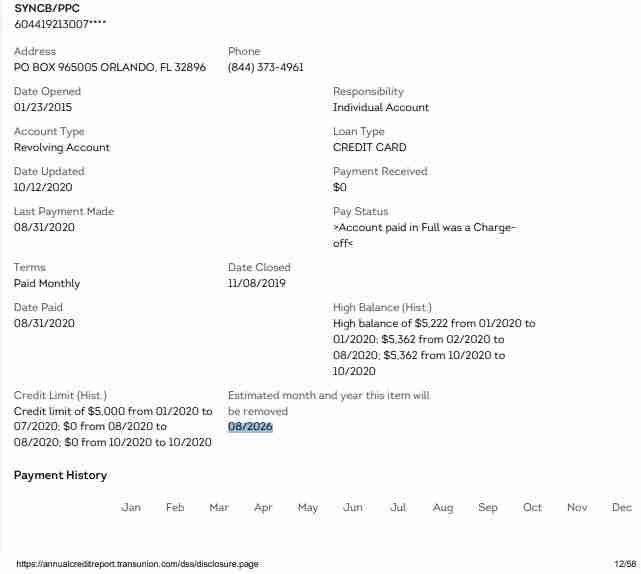

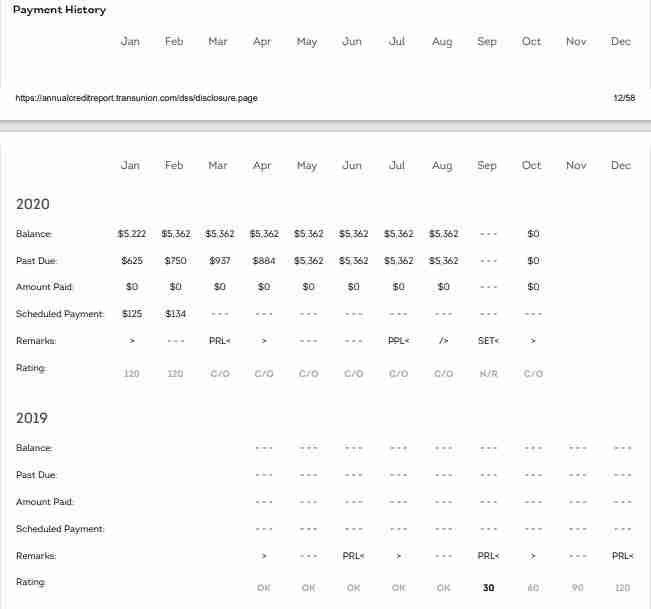

Trans Union Examples

Below are examples from Trans Union reports from Annual Credit Report. We haven’t encountered reports from Trans Union’s website yet, once we do, we will post examples (unless they look the same).

How To Identify Credit Reporting Errors: The Credit Report Analysis

Compare Across The Bureaus (One Of These Things Is Not Like The Other)

Now it’s time to dig into those credit reports! The best method to begin identifying errors is to display the reports side-by-side. Look at each field of information. Compare those across all 3 bureau credit reports. If you see something different, then you know at least 1 of those bureaus is reporting in error. Also if one bureau is reporting information in a field, and the other has no

information in the same field, there again you have found another error. If a field is provided on one report but not on the others, BOOM, another error. Here’s an example, an extremely important field of information, Date of First Delinquency, is always provided by Equifax but never provided by Experian and Trans Union. Now you will see why we believe an accurate credit report does not exist. Lastly, look at the payment history profile, if they look different across the bureaus, or incomplete…. More errors!

Conflicting & Erroneous Information In The Same Credit Report

Another way to identify errors is to look for conflicts within the same report, also look for things that don’t make any sense, such as seeing an on-time payment followed by a 60-day late payment. How is that possible, given there are 31 days in a month at most. The payment history profile in a credit report tend to bring the most errors. Let’s look at this little snippet of this automobile loan to see how many errors we can find just on this account. How many errors can you spot? Keep in mind this is just one snapshot, and not not the complete report on this account. But, you will be amazed at what we will find. Ready? Here we go, errors will be highlighted in bullet points below.

- Missing Payment History Data Just for information, this account was opened in 2015, but notice that 2016 has no payment history reported whatsoever until 3/2017. Notice no positive payments are reflected? This is intentional to run the score down as much as possible. Notice also that the first payment even notated is 90-days late. Where’s the 30 or 60-day late payments? Also notice the lack of payment history data from 4/2017 to 8/2017.

- 2 Repossessions? Notice that repossession is notated twice? This begs the question, was the car repoed twice, or did they repo 2 cars? No, it’s more like let’s cause as much damage to this individual’s credit score as possible by notating repossession twice.

- Missing Date Closed Obviously a repossessed vehicle, and a charged-off account would not remain open.

- Date of Last Payment This reflects 11/2017, yet the car was repoed? Things that make you go hmmmm.

- Delinquency First Reported -This shows 7/1/2017, sure doesn’t look reported in the payment history above.

- Charge-Off Amount & Amount Past Due – I know this image isn’t the clearest, but notice the amounts are different. That suggests a payment was made. Do you see a payment notated anywhere since it went into charge-off status?

- Actual Payment Amount Since it appears a payment was made after charge-off, that payment amount should be reflected there, but alas no data at all.

The Balloon Payment fields are irrelevant as this is an auto loan and not a balloon mortgage loan, also Deferred Payment would only apply if there were deferred payments allowed on this account. Scheduled Payment Amount would apply if this is an open and active account. As you can see, this is just half of the credit report on this account, and look how many errors we found! Just imagine what we can identify had I displayed the whole report?

Need Help Auditing Your Credit Reports?

How To Identify Credit Reporting Errors: Disputing Credit Reporting Inaccuracies To Improve Your Credit Score

Pre-Litigation Credit Repair In Action

Now that we have found the errors, it’s time to draft the dispute. Our recommendation is to draft 1 letter and send to all 3 credit bureaus via CERTIFIED MAIL. I’ll explain why certified mail in just a moment. In your letter, keep it simple. Put all your personal information, including social security number and date of birth. Inform them that you have found several errors, omissions, and conflicting reporting amongst the credit bureaus. Then list every field of information you are planning to dispute in bullet points. Write how each bureau is reporting it, and briefly explain why you are disputing that field of information. Then at the end of your dispute letter demand deletion or correction to “maximum possible accuracy”.

Why Certified Mail?

You ALWAYS want to send your disputes certified mail. This along with the returned receipt stands as proof that the letter was received. Sending by regular mail, the defense attorney will argue the recipient did not receive the letter. Certified mail gives the recipient no excuse for not investigating your dispute.

How To Identify Credit Reporting Errors: What Happens When Disputed Accounts Are Not Fixed Or Deleted?

The answer to this is quite simple: HOLD THEM ACCOUNTABLE! The awesome thing about the Pre-Litigation Credit Repair dispute method is you can hold them accountable in arbitration or court. We are more than happy to assist you in this process, and answer any questions you have.

Our consultations are always free. Helping you fix your credit, and helping you get paid for fixing your credit is something we love to do. Sure you can do it yourself, and we can guide you, but we can also handle the process from the credit report audit process, the dispute process, represent you in arbitration, or refer your case to our nation-wide network of consumer attorneys, ready to take your case. We hope today’s article was informative. Feel free to schedule your free consultation by clicking any of the buttons in this post.