What They Didn’t Tell Us

Unfortunately, we weren’t taught how to manage credit in school. It’s no surprise many Americans at some point in their lives learn that there are just certain things you don’t do with credit or credit cards. I find it personally fulfilling when I see the wool fall from someone’s eyes as we educate them on how the credit system works. Our whole monetary system is based on credit & debt.

Look at the dollar bill in your wallet. You will find it says “Federal Reserve Note”. When you buy a car, many say the following statement: “I have to pay my car note this week.” So essentially that dollar bill is debt. The only way to make it in this nation, and live a prosperous life, is to learn how to manage credit, and reduce debt.

Why it’s important to manage credit & how the system works

I’ve mentioned this a bunch in my blog posts on credit building, but understanding these basic principles about credit & the monetary system will help you prosper even in bad times. Your credit report is like an old school balance scale. Good credit items are on one side. Bad credit items are on the other, and the needle in the middle is your credit score.

The side that weighs the most determines your credit score. Knowing this simple concept, all we need to know is what makes good credit and what makes bad credit, so we can leverage this to add the most weight on the good credit side of the scale. Below we will explore what makes a credit score.

Credit Score Factors: Essential Knowledge To Manage Credit

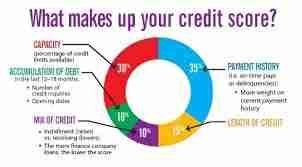

The image below, and the following explanations, while not all inclusive as there are many different credit scores for different purposes, these are a general rule of thumb. Mastering these items will give you the best credit score you can have.

Payment History 35%

Payment History is the largest factor in credit scoring. The credit scoring models are not only looking to see if you are paying on your debts, but also if you are paying them ON TIME. Of course your most recent payment history will have the bigger effect, Although you might not be able to change your past (unless you employ some credit repair), you can change your present and future by simply paying on time each month. Budget appropriately, set reminders on your phone, use autopay, whatever you have to do to ensure your payments are made and made on time.

Credit Usage (Utilization) AKA Debt To Credit Ratio 30%

Of course the credit scoring models, and especially your creditors want to see you using your credit, but the credit scoring models look even deeper to ensure you are using your available credit responsibly. The general rule of thumb is to keep the balance of your available credit below 30%. (ex: Card Credit Limit = $1,000, the max you want charged on that card is $300) This applies to individual accounts and the sum of all your accounts combined. The scoring models love to see it even lower, say around 10% or less to maximize your credit scores. One strategy you can implement now is to pay down your current obligations, and always pay more than the minimum payment.

Credit Age (Age of Accounts) 15%

This one is pretty self explanatory, the older the average age of accounts on your credit file, the better. This is why credit experts always advocate to keep your lines of credit open. For instance you may get a Fingerhut account and not use it, in order to keep it open buy something small and pay it off. You never want to close old accounts as it lowers your credit age, thus reducing your credit score. If you are just starting out, or rebuilding your credit, we can show you a neat trick to add age to your credit file.

Credit Mix 10%

This one is also self explanatory. The scoring models, and lenders like to see how you manage multiple types of credit. They don’t like to see all credit cards, or all loans. Try to diversify your accounts. We typically

recommend to our clients who are starting fresh, 2 revolving accounts (credit cards, charge cards) and 3 installment accounts as a pretty good mix. There is no golden rule on that, but ensure you are mixing it up some. We offer all types of credit builders on our website.

Hard Credit Inquiries 10%

Inquiries are most talked about but have for the most part the least impact. After 1 year their effect diminishes, and Of course, we recommend not apply for credit unless you need to. Watch this video for pointers about avoiding hard inquiries, especially when applying for a big purchase like a car or a home.

Why Manage Credit, When You Can Pay Cash For Everything?

With record inflation, having credit is hugely important. I know many who want to be “credit invisible” but the fact remains, our Dollar is losing purchasing power fast! I remember not so long ago, $100 used to get you cart full of groceries, now you’re lucky to walk out of the store with 2-3 bags. That being said, given that our monetary

system operates solely on debt and credit, you want credit in order to have the purchasing power you need. The Federal Reserve is steadily pushing us into recession in 2022 with their rate hikes. It will come to a point where a cashless society is the norm. If you don’t have much credit, or a credit profile at all, we want to help you build a credit profile, so it is there in the time of need. Schedule a Free Consultation or visit our website to explore the credit building options we have.

Final Thoughts

It is critical to manage credit responsibly, you will need it at some point in the future. Guaranteed. If your credit is less than perfect, if you need credit, or if you have no clue how to manage credit, Credit Wellness Solutions is here to help! Did you know that you can GET PAID for fixing your credit? At Credit Wellness Solutions, we are not your

average credit repair company. We offer a variety of services that help you regardless of your situation. If you need to fix your credit, we employ credit repair methods that actually work, and can get you compensation for errors on your credit report, or lack of investigation by the credit bureaus. If you have debt collectors harassing you, we can help put a stop to that, and get you PAID for their violations of the FDCPA. To fix, or build your credit, schedule a Free Consultation, and let us show you how you can GET PAID for fixing your credit.