is a recession coming?

Recent moves by the Federal Reserve central bank to combat runaway inflation by raising interest rates have stirred the stock market into a rapid drop. As a result, media outlets and top economic gurus have suggested that a recession is near. It is my

personal belief that an economic recession is coming, in fact I believe it is coming like we have never seen in our lifetimes. Will it turn into another great depression? Probably not, but it could be far worse than the 2008 housing market crash. If you have noticed, the Federal Reserve’s move to slow inflation at least so far has not worked. Just take a look at gas prices. They have jumped exponentially overnight! This is another sign that more rate hikes are coming and more rampant inflation is to come.

why good credit is important in a recession

Good credit in a recession is critical for survival. The median savings of Americans is only between $3,000 – $5,000. At most this is enough to cover a month’s worth of expenses. As much as we educate our clients not to do this, life happens. What if you lost

your job? What if a critical unexpected expense makes the need to access credit necessary? You may need to rely on your ability to access or use your credit temporarily until you can secure another job or the funding needed for unexpected expenses. As I just said, we advise against this, but life happens and you will need credit to survive. Likewise, during a recession people tend to tighten their belts and hold off on spending, especially major purchases like housing or buying a car. Good credit coming out of a recession is just as important. Homes require maintenance, vehicles wear out and need to be replaced. Having good credit coming out of a recession can help you make those necessary home improvements, or allow for you to replace your aging vehicle.

Improving your credit now can help you survive a recession

Everyone can benefit from improving their credit profile (except those with 850 credit scores). Increased credit scores bring access to even more credit, and brings with it perks and benefits like crazy low interest rates, and huge lines of credit. At Credit Wellness Solutions, we can help just about anyone improve their credit. All it takes is willingness,

time, good habits, and education. Before we talk about things you can do to improve your credit on your own, let’s talk about some options you have to repair your credit through our credit repair program.

Credit repair could recession proof your finances

Having access to credit during a recession could be the very thing that gets you through the tough times should an emergency arise. Quick Disclaimer: We do not advocate nor recommend using credit to pay your bills and live on. If your credit is less than optimal, access to credit in times of need will be difficult at best to come by. Fixing your credit now, may be the thing that gets you in position to make it through this upcoming recession. We have variety of services that can help you improve your credit. Everything from our credit repair plans, credit building, and credit education will help. Perhaps debt collections are holding your credit back. Our debt collection audit service can help you get rid of those collections. All of our credit repair plans include debt collection audits. Also, unlike other companies doing only “standard” credit repair, we can help you get those charge-off accounts that have become more increasingly difficult to get removed. How is that possible? If your charged off account has an arbitration clause, we can leverage that to hold the credit bureaus, the creditor, or both accountable for reporting your credit information fairly and accurately. Trust me, even if you think it’s accurate, I am willing bet I will find the exact opposite. I have yet to see an “accurate” credit report. By using arbitration, we can not only get those accounts removed, we can get you compensation for the errors and omissions on your credit report. To take advantage of our credit repair programs, click here to schedule your Free Consultation. There is no obligation to sign up, but you will at least leave your consultation empowered to get your credit fixed.

Things You Can Do Now To Prepare Your Credit For Recession

The good news is there are several things you can do right now to get some credit score gains to get your credit ready for recession, without credit repair. Although, these things do compliment credit repair, and credit repair will not be a complete success without these basic principles, practices, and programs. Let’s elaborate..

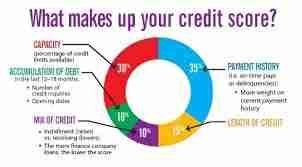

- Learn The Credit Scoring Factors, Adjust Your Habits, Capitalize On Opportunities – So many credit score points are sacrificed by not knowing how credit the credit reporting industry works, and how credit scores are generated.

- Pay Your Current Bills ON TIME – Payment history is the biggest factor of them all. Paying your current bills on time will help you keep your credit score up. Late payments hurt your credit more than anything!

- Pay Down Your Credit Card & Other Revolving Debts – Capacity (Utilization) or Debt to Credit Ratio is the second biggest credit scoring factor. This is the amount you have charged up versus the credit limit. If the usage of your credit exceeds 30% of your credit limit (EX: 30% of $1,000 is $300), you are losing valuable points on your credit. Paying down your debt, increasing your credit limit, or if warranted getting another credit card, can help you lower your usage and give you more points on your credit score. (Hint: 10% Utilization is even better!) Just remember less = more!

- Don’t Close Out Accounts – The age of your credit matters, and accounts for roughly 15% of your credit score. Closing out open credit lines, lowers your credit age and in turn lowers your score. Also, credit card companies want you to use their credit card, if you do not use it, the creditor closes the account. Try to use the card at least once a month. You can do this by doing something you would normally pay cash for, like buying gas.

- Don’t Apply For New Credit Unless You Need It – Inquiries can lower your score. This accounts for roughly 10% of your score. Try not to apply for credit unless you need to for credit building purposes, or unless you absolutely need to make a major purchase.

- Establish A Healthy Mix Of Credit – The credit scoring models love to see a variety of account types on your credit report. This also helps establish a representative report for lenders to see how you handle credit. Try to ensure you have a good mix of credit. (EX: 3 credit cards, 1 Auto Loan, 1 Personal Loan). Credit mix accounts for roughly 10% of your credit score.

- Use Our Credit Building Resources To Help You Increase Your Credit Score – One big way to increase your credit score is to offset your bad credit items with good credit items. If you have read our series of articles on credit building, you have seen the balance scale reference. Imagine the balance scale, you have bad credit items on one side, and good credit items on the other. The needle in the middle is your credit score. The side with the most weight determines your credit score.

If the bad credit side weighs the most, adding positive credit can lessen the effect of the bad credit and increase your credit score. We have seen clients increase their credit score 30-60 points through credit building alone. Combine that with our credit repair program helping to remove or improve bad credit items, the good credit side of the scale begins to outweigh the bad credit side boosting your score even more! Click Here to take advantage of our credit building tools. Many of these tools are instant approval with no credit check! Click Here to read our articles on credit building to learn more.

Recession is coming, prepare now

In conclusion, it’s not a matter of if a recession is coming, it’s when. I personally believe the recession will begin to reveal itself in the next 6 months or less. Are you prepared? We offer everyone a Free Consultation. Take advantage of this and let us analyze your credit report and show you how we can help you prepare your credit going into the coming recession. Click Here to request your free appointment. Click Here to get your 3 bureau credit reports for only $1. There’s no obligation to sign up or purchase anything. Let us help you prepare.