Revolving Accounts. You know what that means. Credit cards, open ended loans on a credit limit, etc. Probably the most valuable asset when it comes to building healthy credit. I know what you are thinking if you are a credit repair candidate. This is what got me in trouble to begin with. You see, revolving accounts can be your best friend or your worst enemy. In our last article on the

topic of credit building, we’ll discuss how revolving accounts are literally the best tool in credit building. However, they become your worst enemy if you don’t know how to handle them responsibly. If you missed our other posts in our series on credit building, be sure to check out our blog.

Why Revolving Accounts are the credit builder’s best friend

One of the biggest factors in building a good credit score is how we handle revolving accounts. Nothing speaks more to a lender than the way we handle an open line of credit, available for us to use at any time, on our terms. It is kind of like dangling the carrot in front of a rabbit. Does he eat it all at once, or does he nibble a little bit? The credit scoring models look more into how we handle revolving accounts more than any other account. Why? Because it shows a lender how responsible or frivolous we are. Because the credit scoring models look at revolving accounts more, to build a healthy credit profile, and a robust score, you must have some revolving trade accounts reporting. This is why revolving accounts are the credit builder’s best friend.

what do the credit scoring models look for with revolving accounts?

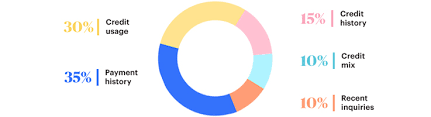

We’ve discussed the credit scoring factors in our other posts, but it bears repeating because it is that important. The 2nd most impactful factor, credit usage, is a direct look at revolving accounts. How much of our credit limit are we using. I have had some clients think that the more you use the

higher your score goes. Nope, in fact the less you use the better! The general rule of thumb is no more than 30% of your available credit. For example, on a credit card with a $1,000 credit limit, you want no more that $300 charged on it. However, according to credit industry expert John Ulzheimer, 10% or less is even better. The biggest factor, payment history, is self explanatory. Pay your bill ON TIME.

handling revolving accounts responsibly

- Use the card only on things you would have used paid for anyway.

- Before the statement date, Pay it down, or pay it off.

- Emergencies only! If you have to use the card for something you normally would not buy, let it be for emergencies only.

- Use the card! Some people make the costly mistake (credit score) of not using the card at all. Banks will close the account for non usage which will cost you valuable points on your credit report.

Types of revolving accounts

There are two types of revolving account, unsecured and secured. Both have their advantages and disadvantages. The type of account will determine if your credit is checked, possibly your interest rate, and it will also determine your credit limit. Let’s discuss both types.

- Unsecured Cards – An unsecured credit card requires no up front deposit. Essentially the issuing bank is trusting you with a line of credit. These cards almost always require a credit check. Your credit limit and interest rate are determined by your credit score, or by their cardmember terms. With responsible use, the issuing bank may increase your credit limit.

- Secured Cards – A secured credit card requires an up front deposit. The amount of the deposit is determined by the issuing bank. This deposit will likely be, or determine your credit limit. Most of these cards do not require a credit check. These cards are typically used for people who are just starting out with no credit, or those with really low credit scores that are in a credit repair program or rebuilding their credit. With responsible use, the issuing bank will make the card “partially secured”, or even unsecured altogether, and give you a higher credit limit.

Where you can get revolving accounts

You can find all of our credit building options on our website. I wanted to take a minute and highlight a couple resources for revolving accounts in particular. These are great resources that will help you build a very robust and healthy credit profile.

Credit Builder Card

Credit Builder Card is an awesome secured card. $200 security deposit gets you started with your very first credit card, or helps you rebuild your credit while in or after the credit repair process. They report to all 3 credit bureaus up to 6 times a month to help boost scores and add positive credit to your credit profile. To get a Credit Builder Card, Click the Image to the right.

Credit Card Broker

Credit Card Broker is a one-stop shop for multiple types of lending geared for building or rebuilding credit. Secured cards, and even some Unsecured cards. They even offer credit monitoring services, installment loans, and even Auto Loans! Check them out if you are looking to build or rebuild your credit. To see their latest offers, click the image to the right.

Self Lender

Self Lender starts a savings in a CD account that becomes yours when you finish making payments, however the neat thing about Self Lender is you can have the opportunity to have 2 credit building tradelines reporting to all 3 bureaus. Not only do you get an installment loan reporting on your credit, but after 3 on-time payments and $100 in savings progress on your loan, Self will give you access to their credit card. This gives you an installment account, and a revolving account reporting on your credit reports. Click the image to the right for Self Lender.

Final Thoughts

Revolving accounts make for a great opportunity to build a robust and healthy credit profile if handled responsibly. If you need assistance in building the perfect credit profile, or help restoring your credit profile during the credit repair process, schedule a free consultation with us. We would love to help you achieve your credit goals!