How Credit Building Can Be As Effective If Not More Effective Than Credit Repair In Boosting Your Credit Score

Think of your credit report as a balance scale. You have your satisfactory accounts on one side, your derogatory accounts on the other, and that needle in the middle is your credit score. The credit score is lower on the derogatory side, and the higher on the satisfactory side. Obviously, the side with the most weight determines your credit score. This post today is only part 1 of a multi-post series to educate you about credit building. Why it’s a huge key to your success in your journey of restoring your less than perfect credit profile, or on your journey of starting your credit with a solid foundation. During this series we will show you many items that can help you either build a solid credit profile from the ground up, or employ to improve your score by offsetting negative items on your credit report. I will link each article as I write them at the bottom of this post.

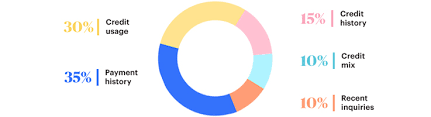

The Basic Anatomy Of A Credit Score

In order for the credit building process to work at its maximum potential, we must first understand the factors that affect your credit score, and how to manage credit properly. Without this knowledge, your journey will end before it begins. I’m not going to go into great detail about the FICO Scoring Buckets as that is a whole other animal that even experts don’t fully understand.

However, understanding these basics will take you a long way and will be your best asset moving forward. These factors are general rule of thumb as there are multiple types of credit scores and scoring models, and each one is a little different. If you master good habits with these factors, you will experience the lifestyle many people only wish they had. Let me let you in on a little secret… You don’t have to be rich or have a lot of money to enjoy a lifestyle of having reserve money for emergencies, and having some of the basic elements of the American Dream (A Home, A Nice Car, Traveling, ETC). Now let’s touch on these factors individually.

Payment History 35%

Payment History is the largest factor in credit scoring. The credit scoring models are not only looking to see if you are paying on your debts, but also if you are paying them ON TIME. Of course your most recent payment history will have the bigger effect, Although you might not be able to change your past (unless you employ some credit repair), you can change your present and future by simply paying on time each month. Budget appropriately, set reminders on your phone, use autopay, whatever you have to do to ensure your payments are made and made on time.

Credit Usage (Utilization, Debt/Credit Ratio, etc) 30%

Of course the credit scoring models, and especially your creditors want to see you using your credit, but the credit scoring models look even deeper to ensure you are using your available credit responsibly. The general rule of thumb is to keep the balance of your available credit below 30%. (ex: Card Credit Limit = $1,000, the max you want charged on that card is $300) This applies to individual accounts and the sum of all your accounts combined. The scoring models love to see it even lower, say around 10% or less to maximize your credit scores. One strategy you can implement now is to pay down your current obligations, and always pay more than the minimum payment.

Credit History (Average age of your accounts) 15%

This one is pretty self explanatory, the older the average age of accounts on your credit file, the better. This is why credit experts always advocate to keep your lines of credit open. For instance you may get a Fingerhut account and not use it, in order to keep it open buy something small and pay it off. You never want to close old accounts as it lowers your credit age, thus reducing your credit score. If you are just starting out, or rebuilding your credit, we can show you a neat trick to add age to your credit file.

Credit Mix 10%

This one is also self explanatory. The scoring models, and lenders like to see how you manage multiple types of credit. They don’t like to see all credit cards, or all loans. Try to diversify your accounts. We typically

Hard Inquiries 10%

Inquiries are most talked about but have for the most part the least impact. After 1 year their effect diminishes, and Of course, we recommend not apply for credit unless you need to. Watch this video for pointers about avoiding hard inquiries, especially when applying for a big purchase like a car or a home.

Credit Building Is An Easy Way To Boost Your Score

Now that we understand the basics of a credit score makeup and what affects your credit score, let’s discuss why and how credit building can boost your score so easily. Knowing the credit scoring factors above is your first place to start. Take a look at your credit report and determine what is needed

to help your credit profile’s immediate needs. For instance, if you see you have nothing but revolving accounts (credit cards, charge cards, open ended line of credit, etc), then adding a couple installment accounts will boost your score. If your credit age is young, consider adding accounts that report retroactively such as a Rent Reporting, or being added as an authorized user on someone’s credit card. If your debt/credit ratio is higher than 30% then becoming an authorized user or opening a new credit card can help. If you are establishing credit for the first time, a secured credit card or a starter loan is the way to go. Regardless of your credit situation there are credit building options available to you. If you need assistance in choosing the right path, we at Credit Wellness Solutions are glad to help! Schedule a free consultation with us, and we will help you navigate your credit building journey, and also your credit repair needs as well. Stay tuned, each week we will be adding a couple more posts on credit building, and explore the options you have. Links to each article will be posted below.