Want to know the real reasons credit disputes don’t work? Consumers are increasingly finding that the big 3 credit bureaus, and their creditors by in large are ignoring their disputes. The Consumer Finance Protection Bureau (CFPB) has even published an article about it you can read by clicking here. Today we are going to discuss the top 5 reasons why credit disputes don’t work. Keep reading, or click the button below to learn more about the dispute methods we use that can get our clients paid for credit report errors.

The Top 5 Reasons Credit Disputes Don’t Work

Before we begin, let’s clear the air. Not all the reasons listed in this article are because of illegitimate disputes. Let’s face it, the credit bureaus and creditors could care less about your credit report being accurate. We see it every day in the responses we get, even with disputes that spell out every error. It’s just the nature of the credit industry. But by the end of this article, you will learn how you can fight back, and get paid for those errors.

5. The Big 3 Credit Bureaus, And Your Creditors Don’t Conduct A Reinvestigation Or They Conduct A Shoddy Reinvestigation

Even the best framed factual disputes based on real errors can go ignored, or limited corrections can be expected. The Fair Credit Reporting Act (FCRA) is the law that governs the credit industry, and how consumer disputes are handled. They must have “reasonable procedures” to conduct a

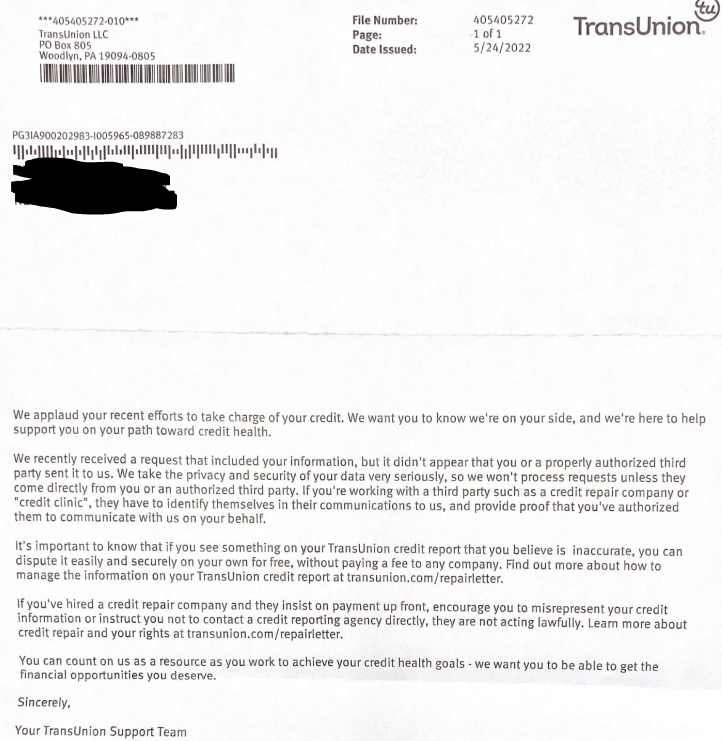

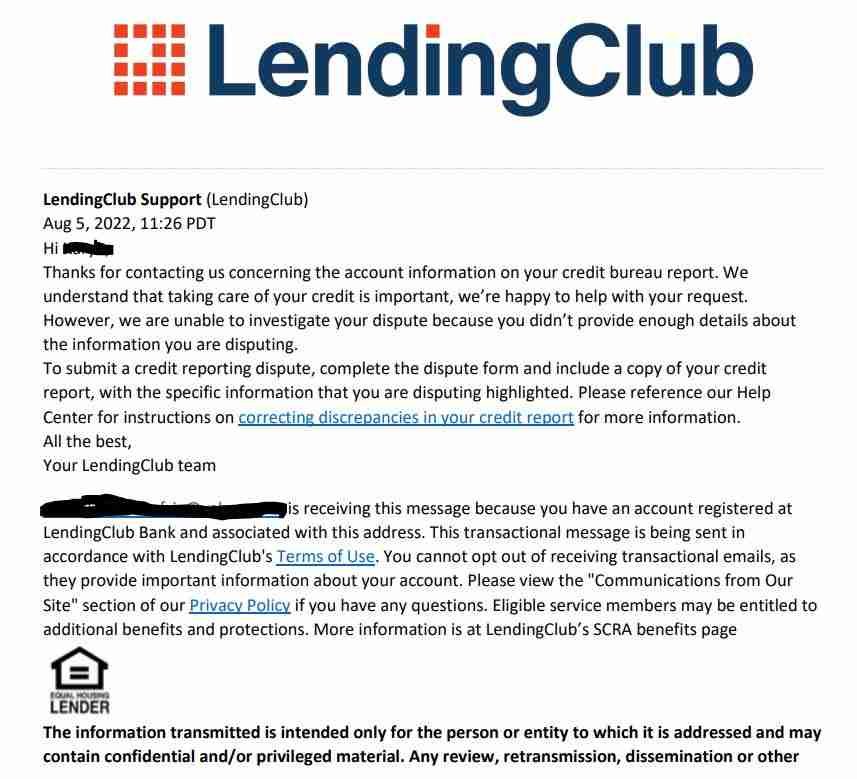

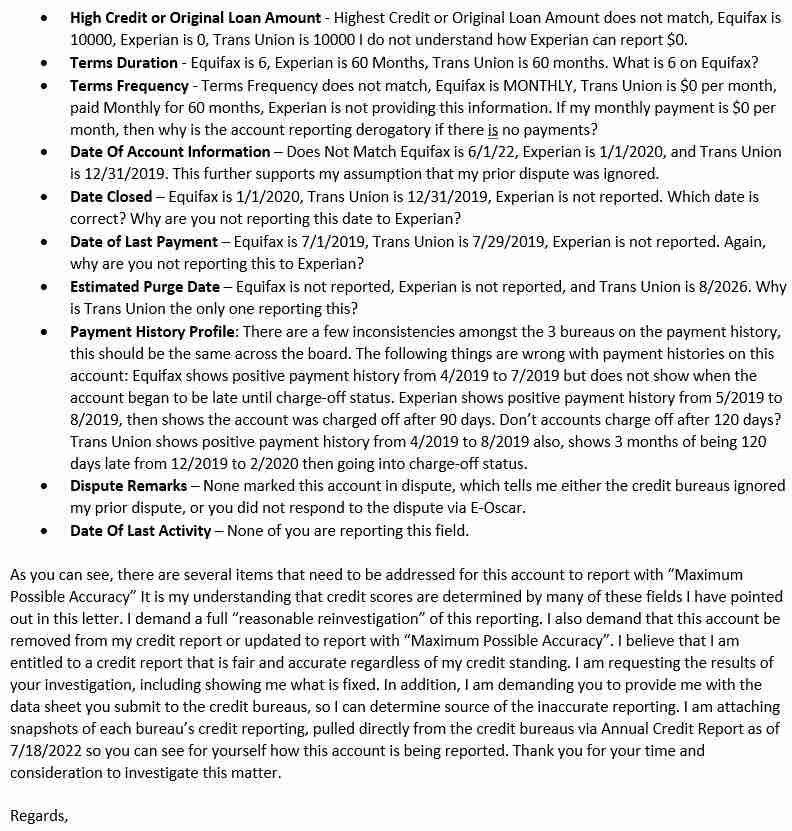

“reasonable reinvestigation”. Somehow, they weasel their way out of investigating consumer disputes by claiming they are frivolous, or they came from a 3rd party, such as a credit repair company. Here’s a hint, if the disputes are truly not frivolous (we will discuss frivolous disputes later), then there’s no excuse for not performing their obligation under the law, even if the dispute was sent by a 3rd party (yes there’s legal precedent for that, and congress is considering a law to further cement that fact). Below are a few examples of a shoddy investigation, or a lame excuse for not investigating. To hold the bureaus and creditors accountable, click the button below, or keep reading.

Examples

As you can see from the above example, even a factual dispute can be ignored, or illicit an ignorant response. We will dig deeper as we continue to show you the reasons credit disputes don’t work.

4. The Sheer Volume Of Consumer Disputes: What Happens To Your Dispute Once The Credit Bureaus And Creditors Receive It?

Another of the many reasons credit disputes don’t work is because of the enormous volume of consumer disputes. The credit bureaus, and many creditors receive so many disputes in a day that it is a known fact that consumer disputes are sent overseas to very low paid workers. They don’t have time to actually read your dispute. They scan your dispute for key items, spending a minute or two tops. One of two things happen after that. The first is they select the standard pre-written (or canned) response letter to send back, or they take key points and turn it into dispute codes and transmit over an automated system called E-Oscar where the reinvestigation process can begin. So

even if your dispute passes the sniff test, it becomes a vague code where the individuals who receive those codes don’t really know the substance or the reasoning behind your dispute. This is why even a detailed factual dispute can trigger a stupid response like the one in the example above, or trigger the “We think a credit repair company wrote this” canned response letter.

3. the Errors Are negligence or intentional, especially on negative items, such as a charged-off account

For whatever reason, you defaulted on your debt, or you made a payment late. In the creditor’s eyes, you have now become a horrible and dishonest person. For that you must pay. They must cause as much harm to your credit report as they possibly can. How is this accomplished? Through errors on your credit report. Things like removing all of your positive payment history before your account was

charged-off. Another great example is marking an on-time payment, followed by a 60-day or more late payment. Well how can you be 60-days late if there is only 31 days in a month at most? That is because in their eyes, you screwed them over, and they want to return the favor.

Your credit score is generated by computer algorhythm based on the information in your credit report. Metro2 is the format in which credit information is reported to the big 3 credit bureaus, and the Metro2 fields are displayed on your credit report. Knowing this fact, the credit scoring models see these errors, intentional or not, and calculate your credit score. These errors can cause your credit score to be artificially low. So in my examples of errors above, if the credit scoring models do not see any positive payments, or payments later than they really were, it does more damage to your credit score than what it

should have done. Let’s face it, the banks make money by lending consumers money. Although there may be many banks, there is ultimately one bank in the United States. That is the Federal Reserve. Don’t let that name fool you. It is not a government bank, it is a private bank. Neither is it a “reserve”, but that’s another topic for another day. So essentially our financial system is one big buddy club. They want consumers that they can make money from, not ones that cost them money. This is why they intentionally damage your credit as much as possible. To warn other lenders not to lend you any money.

If you want to learn more about our “Federal Reserve” system, I highly recommend the book, The Creature From Jekyll Island, by G. Edward Griffin. It is rather eye-opening to how our system really works, and explains the inflation chaos we are seeing today. Here is a link to the audio book on YouTube.

All this being said, when a consumer disputes the errors on their credit report, the credit bureaus who are not in business to give you credit reports, but the banks who pay them to maintain a database on your credit history, are not interested in making their biggest customers mad at them. This is why they allow the errors to report, and why your dispute will likely be ignored, or the reinvestigation of your dispute will be botched at very best. If reading all this ticks you off (and it should), click the button below to fight back, make them pay you for their errors, or keep reading.

2. False Claims Of Identity Theft

This one is self explanatory. Unfortunately, this happens more often than I probably want to admit. A notorious group of credit repair scam artists advertise all over social media their method of credit repair that claims you will see results in 2 weeks. That method is called a “credit sweep”. For one flat upfront fee (which is illegal for credit repair companies) they will get you to file a police

report, claiming identity theft. Then they will send a dispute to the credit bureaus in your name, claiming you have been a victim of Identity theft. Naturally, the credit bureaus will react and delete the disputed items from the credit report PENDING INVESTIGATION. Although this gives the client a nice score boost, once the investigation is complete and the claims were found to be false, the disputed accounts return to the credit report with a vengeance. Vengeance such as pressing charges on you, and if discovered, the credit sweeper. Bare minimum, you will face steep fines, but you and the sweeper can spend time in jail.

It’s best not to use desperate tactics when disputing such as claiming identity theft. Avoid anyone advertising a “credit sweep”. There are plenty of ways to fix your credit the legitimate way, some ways can actually PAY YOU. Keep reading and we will show you how you can GET PAID to fix your credit.

1. 609 Dispute Letters & Non-Factual Disputes

609 Disputes

609 Dispute Letters are total garbage. They do not work at all, nor should they work. I wrote on this topic in great detail you can read here. 609 Dispute letters are based on a misconception of a provision of the FCRA that the Big 3 Credit bureaus must give the consumer a full disclosure of everything in their credit file upon request.

The misconception, or misinformation comes from people who believe that the credit bureaus have to provide original signed contracts and other loan originating documents. This thinking is flawed at best because, the credit bureaus only maintain data submitted to them in Metro2 format which is only basic account information you see on a credit report. Also think of this, when you got your last credit card, did you sign a contract? Likely not. When you get a credit report from the credit bureaus’ website(s), or Annual Credit Report, they have satisfied section 609 of the FCRA.

Non-Factual Disputes

I lumped this in with 609 disputes because 609 disputes also tend to be non-factual, but non-factual disputes can also be independent. Once again, this is total garbage. Claiming things such as the account is “not mine” or I was “never late”, will do you absolutely no good. Those disputes typically find their way to the canned response pile very fast. So you’ve sent 4 rounds of these

letters to the credit bureaus and the furnisher, and absolutely nothing changed on your credit report other than a dispute remark. What do you do next? If you think suing them, or taking them to arbitration is an option, think again. No attorney in their right mind would take these disputes to the courtroom or arbitration. So, you do it yourself and go pro se. Guess what? Your case would end in less than 5 minutes with a judgement in favor of the defendant, and perhaps a court order to pay your debt. There’s plenty of legal precedent to back me up on this.

What’s sad to me is some credit repair companies use this garbage in their credit repair programs. Also, so called “credit gurus” are selling these books and letters as some sort of secret credit loophole. 609 dispute letters and the non-factual are found online in mass. Avoid online templates, and these magical “credit secrets” books, and you will find real and reputable credit repair companies, and online material that can help you. Keep reading to learn more about disputes that can actually PAY YOU, and how Credit Wellness Solutions can get you there. Click the button below to get started with Credit Wellness Solutions.

How To Dispute The Right Way, And Possibly Get Paid For Fixing Your Credit

It is always best to just simply stick to the facts. You will find plenty of errors on your credit report to dispute legitimately. This website claims that credit reports are 98% accurate. The CFPB pretty much says the same. However, I have said this in my other articles, and I’ll say it again here. I have yet to see an accurate credit report.

I am more willing to bet the actual statistics are reversed where 98% of credit reports are inaccurate. Recently, I posted an article that shows you how to identify credit reporting errors. Pull your credit reports yourself, and read this article. I am willing to bet you that you will find your credit report is no where near accurate.

Getting Paid To Fix Your Credit

All that being said, you may find that sticking to the facts may not get you a deletion, even if your dispute is thorough and detailed. You may get the idiotic responses like the examples given earlier in our post. But unlike 609 disputes, a good factual dispute will hold up in court or arbitration. This means you could get awarded compensation for those damages. This is exactly how we dispute for our clients. If we get the credit fixed, that’s great. If we get stupid responses, our dispute is ignored, or we don’t get the deletion and your credit report still has errors, that’s even better. We will just represent you in arbitration, or we can sue them.